My recent article, How to Budget When You Hate Budgeting, was published at Credit.com here and at Yahoo Finance here. In this article, I explain the simplified system that my wife and I use to become more mindful about our spending.

My recent article, How to Budget When You Hate Budgeting, was published at Credit.com here and at Yahoo Finance here. In this article, I explain the simplified system that my wife and I use to become more mindful about our spending.

One of my good friends, an English major, gave a “hear, hear” to this line:

It’s as if everything we now know about budgeting was written by accountants for people who think like accountants.

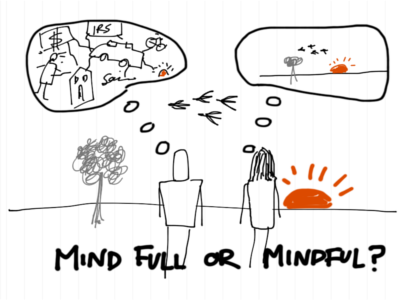

The system we now use which I call Budgeting Lite takes us about two minutes a day. After researching several different expense tracking tools, I found that You Need A Budget (YNAB) works best for my family. Budgeting Lite only requires a fraction of the capability that YNAB offers but that’s the point. I needed a system that would help us become more mindful about our spending while only spending a fraction of the time that more comprehensive budgeting tools require.

In writing this column, I finally figured out why I dislike most budgeting tools. My editor at Credit.com asked me to remove some of the language that may have be interpreted as negative to their “partners” so I’ll add it back here since we don’t have any such partners that would keep me from total objectivity. As I’ve said before, we are fiduciaries and if you are unsure of what this means or the difference between fee-only and fee-based, please read this.

In any case, when I was using Mint or Quicken, I relied on the transaction downloads which never clearly represented our current financial standing. Was I counting all of my outstanding checks? And then there was the mess of fund flows from one account to another that were unrelated to our monthly spending budget. I was never confident about how much money we had left to spend before surpassing our budget targets. I spent so much time relabeling transactions and trying to piece together what was going on that I finally gave up trying to use online budgeting tools. That is, until recently.

After sharing my Budgeting Lite strategy with the people at YNAB, they were so appreciative of the endorsement and unique budgeting approach, they gave me a 25% discount to pass along to those who want to try out their tools. I always like to note here that as fee-only financial advisers, we do not accept any payments — also known as revenue sharing, kickbacks, or commissions — for referrals. Here’s the information for those looking for a discount:

1. Click on the link http://www.youneedabudget.com/myadvisor.

2. Next to “Use My Code,” enter marotta.