The U.S. markets are doing well this year. Many other asset classes are not. The S&P 500 was up 16.9% at its peak on June 18. Then it dropped 2.9% in the last 10 days of the quarter. This gain in the U.S. markets has some people questioning the merits of a global portfolio. But the track record of diversification is impressive.

Sometimes one asset class does worse than all the others. Sometimes it does better. There is always a first and last place when ranking recent returns. Neither chasing returns nor dodging corrections has been a winning strategy historically.

A balanced portfolio holding U.S. stocks, foreign stocks and resource stocks remains one of the best ways to hedge against inflation and secure financial independence for retirement. As we say, “It is always a good time to have a balanced portfolio.” This is true whether the S&P 500 is the best or worst performing index.

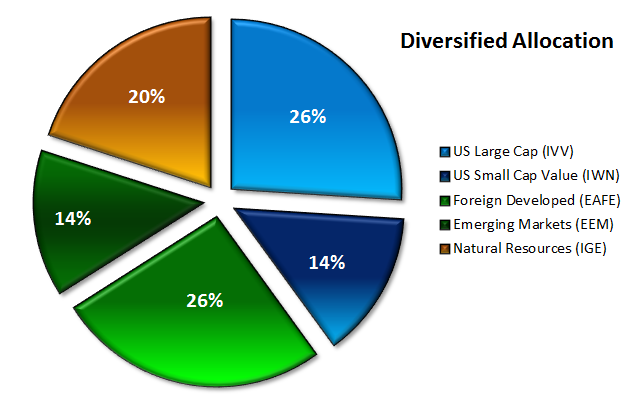

We analyzed a typical diversified portfolio using five exchange-traded funds (ETFs). The asset allocation included ETFs from iShares allocated as follows:

- 26% Core S&P 500 ETF (IVV), representing U.S. large cap

- 14% Russell 2000 Index (IWN), representing U.S. small cap value

- 26% MSCI EAFE Index (EFA), representing foreign developed markets

- 14% MSCI Emerging Markets Index (EEM), representing foreign emerging markets

- 20% S&P North American Natural Resources (IGE), representing resource stocks

We also computed performance based on rebalancing the diversified portfolio monthly.

Rebalancing normally means selling what has gone up and buying what has gone down. This contrarian strategy challenges our intuition. We are wired to hoard what is up and regret what is down. However, when an asset class drops, the best tactic is to rebalance and buy more. And when an asset class rises and investors wish their entire portfolio was similarly invested, the best move is to rebalance and sell some.

To keep our example simple, we rebalanced monthly. However studies suggest that using a longer interval of time or deviation level from the ideal target is superior to monthly rebalancing.

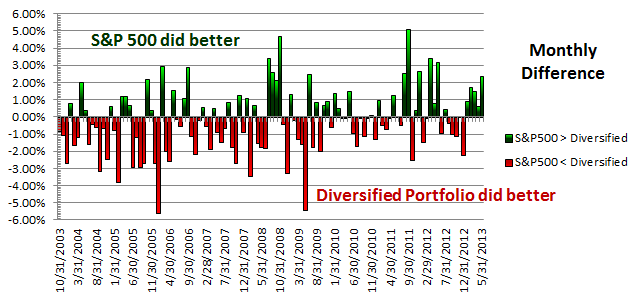

Then we compared the returns of this portfolio against the returns of the S&P 500 ETF (IVV) by itself.

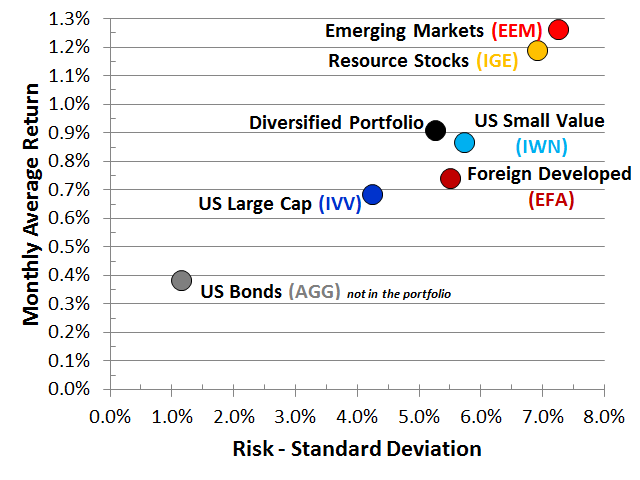

The diversified portfolio had a better average monthly return of 0.906% versus the S&P 500’s 0.685%. This difference of 0.221% compounded monthly equates to the difference between an 11.43% annual return and an 8.53% annual return. The diversified portfolio earned an extra 2.9% annually.

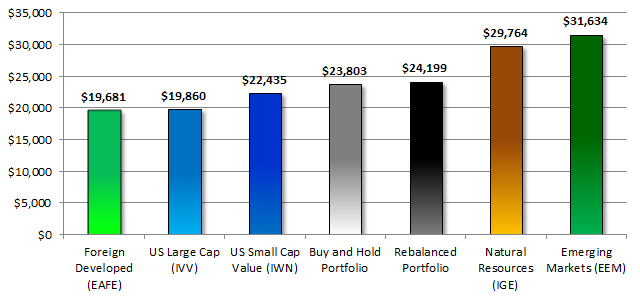

From September 2003 to May 2013 (just short of 10 years; this period is the longest period that all six funds have been available), $10,000 invested in the S&P 500 would have grown to $19,860.

The same amount invested over the same period in the diversified portfolio would have grown to $24,199. Over just short of a decade, the $10,000 investment in the diversified portfolio gained an extra $4,340 over the S&P 500.

Over the same period, $500,000 would have grown to $1,209,939, earning an extra $216,991 over the S&P 500. A $2 million portfolio would have grown to $4,839,756, earning an extra $867,964.

Without rebalancing, the excess return was 9.12% less. A $500,000 investment that is not rebalanced would have only grown to $1,190,160. This is $19,779 less than rebalancing but still $197,162 more than the S&P 500. The rebalancing bonus is significant even using monthly rebalancing.

In any given month, the diversified portfolio never performed better than all of the five indexes. Asset allocation means always having something to complain about. It will never “win.” Not even one month. This is an obvious result of diversification. The diversified portfolio is a weighted average of all five underlying indexes. It can’t possibly be better than all of its components. It will always lose to something. On average it comes in third or fourth (of the six) each month.

The S&P 500 isn’t alone in losing to the diversified portfolio over the long run. The same initial investment of $10,000 over the same period invested in EFA would have only grown to $19,681 and IWN to $22,435.

IGE and EEM, in contrast, would have grown to $29,764 and $31,634, respectively, beating the diversified portfolio.

Natural resource stocks (e.g., IGE) are a smart way to hedge against inflation for a portion of your portfolio. They help balance any bond components. But they do poorly when the dollar strengthens. Even though over this time period the class performed well, it is not suitable for 100% of your asset allocation.

Emerging market stocks (e.g., EEM) performed the best on average over this time period. However, their volatility makes a 100% EEM portfolio too risky to safely achieve your financial goals.

The average monthly standard deviation (SD) for the S&P 500 and the diversified portfolio were 4.25% and 5.27%, respectively. For the S&P 500 that means the average monthly return is between -3.6% and 4.9% for 1 SD. The range is between -7.8% and 9.2% for 2 SDs.

The SD for every other asset class is higher. Emerging markets is the highest at 7.26%. The range of monthly returns for emerging markets within 1 SD is -6.0% to 8.5%. Within 2 SDs, it is -13.3% to 15.8%. That’s monthly, not annually.

The diversified portfolio’s range of returns for 1 SD is between -4.4% and 6.2% and between -9.6% and 11.5% for 2 SDs. The markets are inherently volatile. Blending the asset classes helps include a portion of the returns of riskier, faster growing asset classes like emerging market stocks without experiencing all the gyrations normally associated with them.

Remember that 98% of the daily movement in the markets is just noise. Most of the movements of the market do not affect the overall return of the investment. Up movements pair with down movements, canceling each other out in the long run.

If you pair the S&P 500’s monthly up-and-down movements, 79% are just noise. Only 21% of the monthly movement actually contributes to your ultimate return.

The diversified portfolio does not eliminate this situation. The noise of the markets cannot be changed. But they can be ignored. Noise is only dangerous if you listen to it. The wisest investors ignore daily and monthly market movements. Instead, they periodically rebalance back to their target asset allocation.

Here are five principles to keep in mind:

1. The markets are inherently volatile. If you want decent returns, you have to endure a large monthly SD.

2. Ignore the daily market movements. Also disregard the monthly noise, and don’t let a season in the markets ruin a brilliant investment strategy.

3. Diversification works over long periods of time. One asset class can win for months at a time. It’s better to rebalance than to chase returns.

4. It is always a good time to have a balanced portfolio. Although you may lose each month, you will win in the long run.

5. Planning works better than intuition. Without an asset allocation, you can’t rebalance back to it and received the rebalancing bonus. Without an asset allocation, we are all tempted to sell what has gone down and buy what has gone up. But that is the exact opposite of what we should do.

If you are diversified across all these asset classes, be thankful for your returns. Stay the course, even when you come in third.

2 Responses

George Marotta

Excellent article David & Megan

David John Marotta

This article was included in the July 2013 Carnival of Passive Investing hosted on Rob Bennett’s A Rich Life.