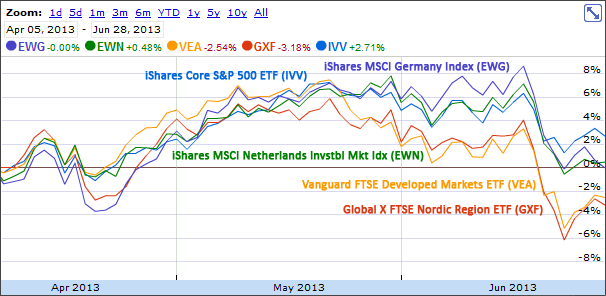

While the S&P 500 did reasonably well during the second quarter of 2013, the global markets did not. Emerging Markets did particularly poorly.

But, in a reversal from past trends, European markets did better:

- iShares MSCI EAFE ETF (EFA) was down 0.93% during the second quarter, but still averaging 7.54% for the last 10 years.

Vanguard FTSE Developed Markets ETF (VEA) was down 0.86% during the second quarter. [VEA has not been an ETF for 10 years.] - iShares MSCI Germany ETF (EWG) was up 2.88% during the second quarter, and still averaging 9.81% for the last 10 years.

- iShares MSCI Netherlands ETF (EWN) was up 2.55% during the second quarter. [VEA has not been an ETF for 10 years.]

- Global X FTSE Nordic Region ETF (GXF) was down 3.51% during the second quarter, but still up 22.34% for the past year.

Meanwhile the S&P 500 was also positive for the quarter:

- iShares Core S&P 500 ETF (IVV) was up 2.90% during the second quarter, but only averaging 7.23% for the last 10 years and 6.96 for the last 5 years.

Diversifying your assets outside of the United States is part of protecting your assets against all being subject to a single country’s economic failure or success.