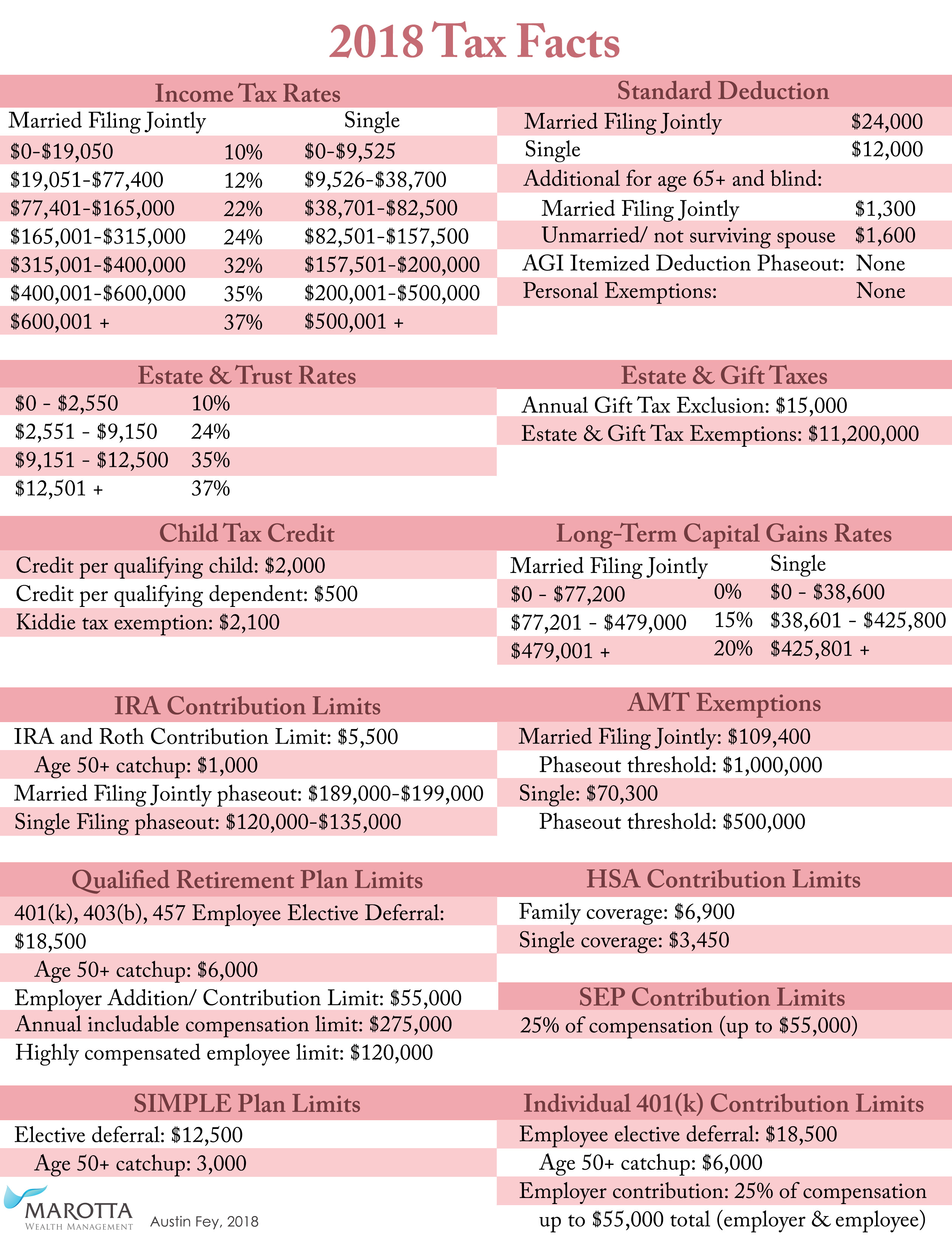

Here are the numbers to use as you’re doing tax planning this year.

While retirement plan contributions either haven’t changed (for Roths and traditional IRAs) or have barely changed (in 2018 you can defer $18,500 instead of $18,000), the income tax bracket rates have changed a good bit.