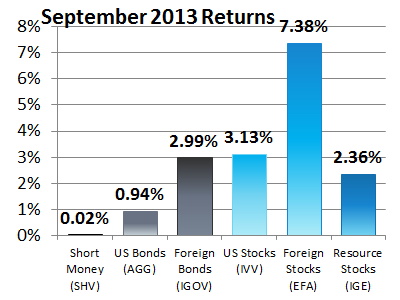

In September 2013 the returns of foreign stocks (as measured by the iShares EAFE Index) beat US stocks (as measured by the iShares S&P 500) by 4.25%.

This continued the trends of July and August and when foreign stocks beat US stocks by 0.17% and 1.55% respectively.

Despite these gains, the iShares EAFE Index has not caught up with the S&P 500 year to date. A the end of September 2013 the S&P 500 is up 19.74% verses the iShares EAFE Index’s 16.10%.

Resource Stocks, as measured by the iShares North American Natural Resources ETF (IGE), lagged in September and is “only” up 10.23% year to date.

Asset allocation means you always have something to complain about. This year, with good returns year to date from most categories, many investors are just complaining that they aren’t invested 100% in US stocks. This despite the fact that the iShares S&P 500 (IVV) was only up 5.23% over the last three months (3rd Quarter 2013) and the iShares EAFE Index (EFA) was up 11.49% over the same time period.

Investors tend to think whatever is up more year to date (in this case US stocks) are continuing to have the best performance even when another category (such as foreign stocks) are actually doing better. For this reason investors often seek to chase returns and under perform.