Choosing the best time to begin claiming Social Security is one of the most significant decisions a retiree will make. When you consider that this income represents an asset typically valued between $500,000 and $1.2 million, you begin to understand its importance to a retiree’s retirement portfolio. There are no one-size-fits-all answers to identify when to start.

Choosing the best time to begin claiming Social Security is one of the most significant decisions a retiree will make. When you consider that this income represents an asset typically valued between $500,000 and $1.2 million, you begin to understand its importance to a retiree’s retirement portfolio. There are no one-size-fits-all answers to identify when to start.

Social Security is also extremely complex. Aside from a basic age analysis, Social Security’s loophole strategies, including “File and Suspend” and “File as a Spouse First,” open the door to hundreds of combinations that should be assessed when picking the optimal filing dates.

Before I jump into the analysis from this case study, I need to share a warning yanked from the intro to Mathnet, a Square One Television show from my childhood:

“The story you are about to read is a fib but it’s short. The names have been made up, but the problems are real” (hat tip to my brother who helped me remember this late 1980s classic program for aspiring math geeks).

Husband: Johnny (age 60); estimated benefit at age 66 is $2,369

Wife: June (age 61½); estimated benefit at age 66 is $1,711

Plugging this information into the Social Security optimization calculator we have created helps identify the amount of Social Security wealth forfeited by claiming Social Security at a suboptimal time.

Johnny and June would forfeit $218,594 in total expected income by claiming their benefits at age 62, the earliest age that Social Security benefits are available.

You can simply think of total Social Security wealth as the sum of all future income payments a couple will receive. More technically, it is the present value of all anticipated income and discounted by the current 10-year Treasury Inflation-Protected Securities (TIPS) yield.

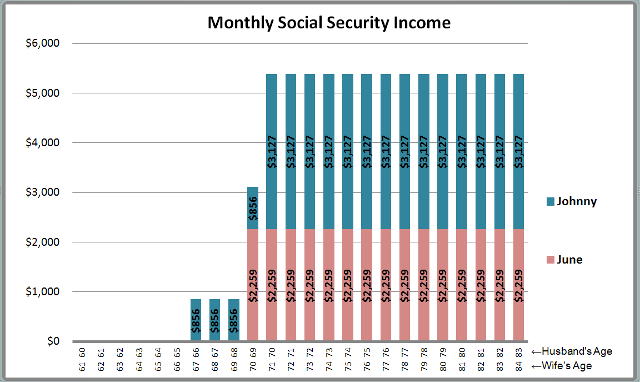

According to this analysis, the optimal age for both Johnny and June is to wait until age 70 to receive the largest possible benefit. After age 70, retirees no longer earn delayed retirement credits, and their monthly benefit maxes out at around 132% of the age 66 benefit and 171% of the age 62 benefit.

Alicia Munnell, director of the Center for Retirement Research at Boston College, argues that we should rename age 70 as the full retirement age (FRA) to encourage more retirees to delay. Currently, most people begin claiming their benefits as soon as they can get their hands on the money at age 62.

Delaying to age 70 is not the best decision for everyone. For Johnny and June, the Social Security loopholes allow for an even greater benefit when Johnny turns age 66. Rather than waiting to age 70, it would be better for June to “File and Suspend“ her benefit just before her husband turns age 66. After this point, Johnny will be eligible to claim a spousal benefit based on June’s earnings record. I call this strategy “File as a Spouse First.”

Johnny must wait until Social Security deems him to be at FRA (age 66 for current retirees) before he can choose to claim only spousal benefits while allowing his own benefit to continue to grow.

Using both the “File and Suspend” and “File as a Spouse First” strategies allow Johnny to begin receiving half of June’s benefit at age 66 until he begins his much larger personal benefit at age 70. Adding four years of spousal benefits offers an extra $41,088 in additional income.

This graph shows how Sam and Betsy’s future Social Security income is optimized:

Make sure you do your homework before filing for Social Security. If your financial advisor is not an expert in these areas, consider using an optimizer like the ones available at Social Security Solutions before making one of the most critical financial decisions of your life.