I’m 25 years old earning $50,000 a year. I’m taking advantage of the fact that my employer offers a 4% match in my 401(k) if I contribute 5%. Am I saving enough to fully fund my retirement by age 65? (I do not want to count on receiving any Social Security.)

Retirement projections which factor in inflation often scare young people. Sometimes it is easier to do everything in today’s dollars and simply leave out inflation. Because we base investment returns on what they earn over inflation (3% over inflation for bonds and 6.5% over inflation for stocks) you get the same answer no matter what you use as the factor for inflation. Although inflation appears to be calm right now, we are going to assume 4.5% inflation which has been a historical average.

Assuming 4.5% inflation, an all stock portfolio would return 11% (6.5% over inflation). Although this might be the average return for an all stock portfolio, most financial planners use a lower number (closer to 7.5% or an all bond portfolio) for planning purposes. The reason is that you don’t want to count on “average” returns. If you plan on “average” returns, then 50% of the time the returns will be below average and your financial plan will fail. In the financial planning world you can never have a 100% chance of your plan working without adjustments, but an 80% chance is consider sufficient for the plan to be successful.

But in this email we are going to assume the optimistic return of 6.5% over inflation or 11% to illustrate what, on average, you should be saving at a minimum.

The equivalent of a $50,000 lifestyle (in today’s dollars) at age 65 after 40 years of 4.5% inflation you will have to spending $290,818 a year in future dollars in 2054. Inflation is one of the more certain retirement risks which people routinely discount. My grandmother used to buy a week’s worth of groceries for a family of 4 for about $4. Would you to have told her she would need hundreds of thousands of dollars for her retirement she would not have believed you. And yet she did.

So you need $290,818 a year when you start your retirement. The safe spending rate at age 65 is 4.36%. Therefore you will need $6,670,143 ($6.7 million) at age 65 in order to fund your retirement.

Assuming that you save 5% of your salary ($2,500) and your employer matches with 4% ($2,000) and that you continue these percentages as your salary rises, and your all-stock investments grow by 11% per year, you will have saved $4,097,389 ($4.1 million) by age 65.

This will have only funded 64.2% of your retirement.

Just to be clear, using percentages of your salary means that in your 64th year the dollar amount of your savings will have grown from $4,500 a year to $25,046 per year. But it still won’t have been enough.

And although they will be able to withdraw $178,646 at age 65 it will only have the purchasing power (in today’s dollars) of only $30,714.

Saving 9% of your salary isn’t enough to fully fund your retirement.

So how much is enough?

If you save 14.65% it should be, on average, sufficient.

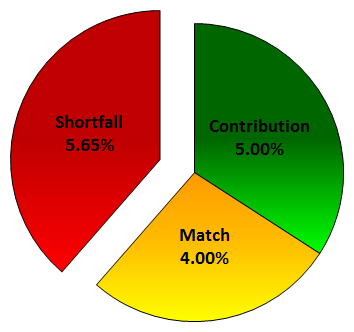

This could be 5% 401(k) + 4% match + 5.65% Roth or any combination which adds up to 14.65%. (It should be noted that saving in a Roth or Roth 401(k) counts a greater amount toward your retirement since you can use the entire amount toward lifestyle and currently will not have to pay taxes when it is withdrawn. I have not included a Roth bonus in any of these calculations.) I have also not included the difference between your salary and your lifestyle (salary minus taxes). Assuming you save pre-tax these calculations are correct as your salary is pre-tax but so is your withdrawal in retirement since it will be taxed as well.

Back to the example, if you save 10.65% ($7,326) and increase that amount as your salary increases, and it grows at 11%, you will have a portfolio of $6,670,143 and will have a safe spending rate of $290,818 to start your retirement.

This is why we will often say that on average you should be saving about 15% of your salary.