2018 Tax Law Changes

The rules on state tax credits have been updated. Read “State Tax Credits Are Becoming Less Valuable” for more information.

The Neighborhood Assistance Program (NAP) encourages private sector investment in alleviating poverty. Individuals and businesses are incentivized to donate to nonprofits that specialize in education, job training, low-income housing, health care, and community services.

The Neighborhood Assistance Program (NAP) encourages private sector investment in alleviating poverty. Individuals and businesses are incentivized to donate to nonprofits that specialize in education, job training, low-income housing, health care, and community services.

Virginia is among several states offering valuable tax credits in return for donations of cash or securities to approved NAP organizations. But you need to plan ahead because these credits are in limited supply. If you procrastinate, you are likely to miss out.

NAP Organizations Make Community Impact

To qualify as a NAP, most of the persons served must be low income or disabled. Church Hill Activities and Tutoring (CHAT) is one of the great qualifying NAP organizations. It runs an intervention high school and offers a variety of inner-city after-school and summer extracurricular activities. I am most familiar with the tutoring program because our home is one of CHAT’s five after-school tutoring sites.

Every Monday and Tuesday, six to ten volunteer tutors come to our house. Many come from local colleges and some are working or retired. Jill Wright started tutoring for CHAT in 2009. While assisting with academics, Jill is one of many tutors to develop a lasting relationship with a particular student. And when Summer graduated out of the Little Tykes (Pre-K – 2nd Grade) program, Jill followed her to our house where the older kids meet. When I asked Jill about her relationship with Summer, she shared, “we have developed a special bond for which I am grateful.”

Like all qualifying NAPs, CHAT receives its allotment of credits by July 1 of each year, following the Virginia fiscal calendar. In the 2013–14 fiscal year, CHAT received $75,000 of tax credits, but it must wait until the end of June to see how much it will receive for this upcoming fiscal year.

Like most qualifying nonprofits, CHAT gives these tax credits away on a first-come, first-serve basis. That means you must act quickly to make sure credits are available. Last year, CHAT’s credits were all gone by September, but in earlier years the organization was given a smaller allotment and those credits were snapped right up.

Donations made before July 1 won’t qualify, which is why there tends to be a wave of giving as soon as the donations become eligible. Many organizations allow potential donors to get on a waiting list and contact these potential donors as soon as the official allotments have been made.

NAP Donors Give and Receive

The tax savings for making a donation to a NAP are huge. A tax credit is far more valuable than a deduction because it reduces your total tax bill dollar for dollar. An individual or business contributing directly to an approved NAP organization may receive a state tax credit for 65% of their total contribution. To qualify, individuals can donate anywhere between $500 and $125,000. Businesses must donate at least $616 but have no maximum cap.

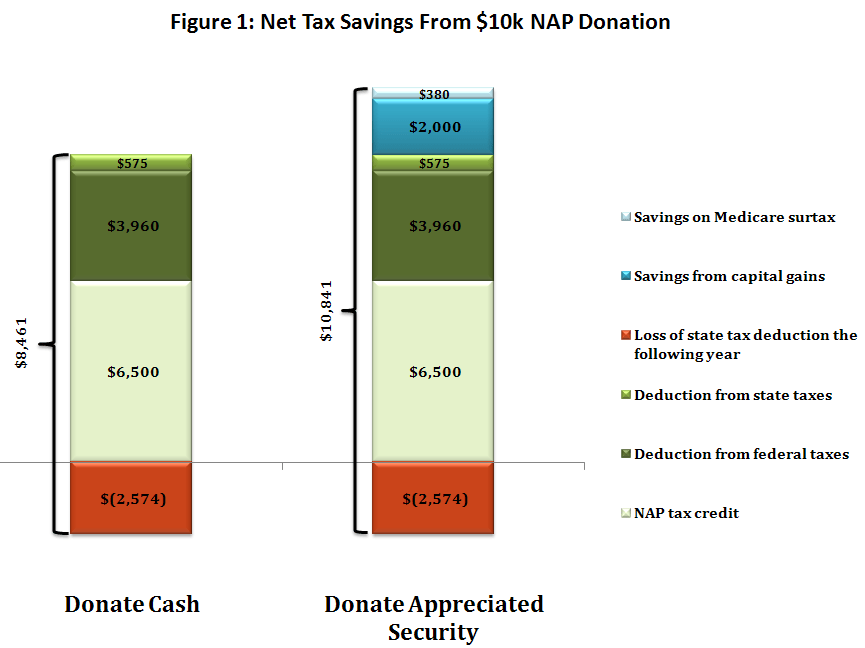

The tax benefits for writing a check are very good, but donating appreciated stock is even better. Assume you plan to gift $10,000 and qualify for a $6,500 tax credit. If you write a check and you’re in the highest marginal tax bracket, you receive a total tax savings of $8,461, which means your $10,000 donation only cost you $1,539. However, if you gift appreciated stock, you can save up to $10,841 in taxes, which means your donation can actually make money for those in the highest tax brackets.

Figure 1 shows the breakdown of the tax savings. In addition to the NAP tax credit, you also can take this charitable donation as a deduction on your personal taxes. If you’re in the highest tax bracket, you will save an additional 39.6%, or $3,960 on federal taxes, and 5.75% in Virginia taxes. However, you also lose part of your deduction for the following year, a loss of $2,574. This loss occurs because you are not permitted to deduct the state taxes paid with a credit.

More savings are available if you gift appreciated stock. If the stock had been sold, a taxpayer in the highest brackets would have to pay a 20% capital gains tax and a 3.8% Medicare surtax.

To receive tax credits for your donation, the NAP organization should be able to help you fill out the Contribution Notification Form. If you’ve been withholding a standard amount of taxes from your paycheck, using tax credits means you’ll get a big state tax refund. If you plan to continue purchasing state tax credits, you may want to reduce your state tax withholding so you’re not lending the state government an interest-free loan for the better part of the year.

For links to the charities that qualify as NAPs, visit our website at www.emarotta.com/nap. If you receive more tax credits than you need this year, you can carry them forward to future years. Give generously this year to help Virginians in need and save money at the same time.