Most of the time when you contribute to a traditional IRA, you are able to contribute pre-tax money, and you take a deduction for this on your taxes. The money grows over your working career, and when you retire and start taking money out of your retirement account, you are taxed on the money you are taking out, which makes sense, because the money was not taxed on the way in.

Occasionally, someone might not take their IRA contribution off on their taxes; this is called a non-deductible contribution. They might do this because they are above the income limit to contribute to a Roth IRA, so by a non-deductible contribution to a traditional IRA, they pay tax on the money, and then they can convert the money to a Roth IRA (we call this a “back door” method of funding your Roth).

If you contribute a non-deductible amount to an empty IRA and convert it to a Roth immediately, the process is fairly simple. If you contribute a non-deductible amount to an IRA, have other IRAs, and want to convert to a Roth 10 years later, the process is more complex.

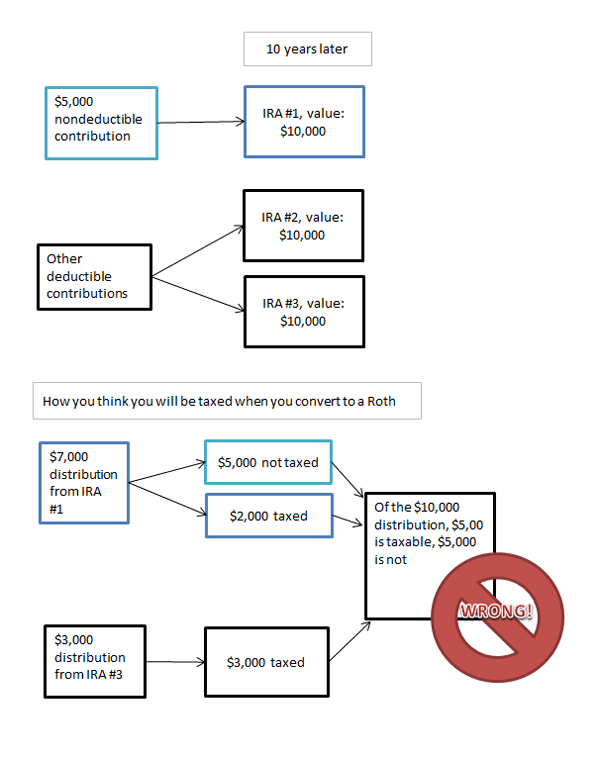

Let’s take an example. Sylvia Saver puts $5,000 in non-deductible contributions into an IRA in 2004. She has 2 other IRAs, and contributes deductible amounts into them. She invests all the accounts, and in 2014, she has 3 IRAs, worth $10,000 each.

Sylvia wants to convert $7,000 from IRA #1, the one with non-deductible contributions, to a Roth. She thinks that when it comes time to pay taxes, she can move $5,000 tax-free, and will pay tax on the $2,000 earnings. Sylvia also converts $3,000 from her third IRA to a Roth, and anticipates being taxed on the whole amount.

Sylvia is wrong.

Her tax preparer informs Sylvia that this is not the case. He quotes from the Slott Report, a blog devoted to answering questions about taxes:

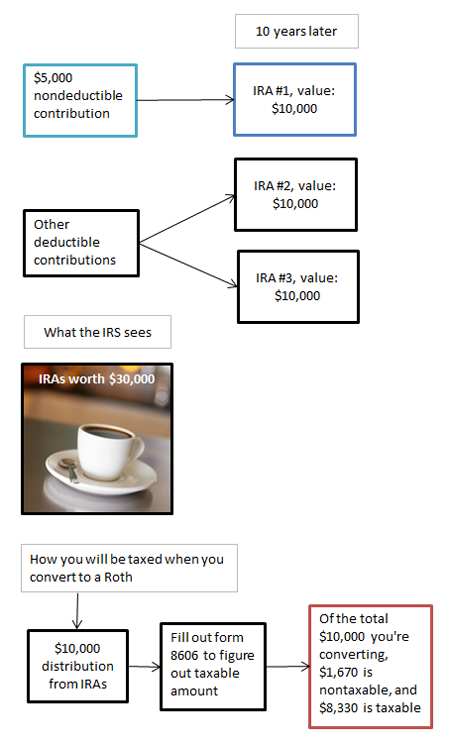

“For tax purposes, all IRAs (except for Roth IRAs) are considered one IRA and your distributions are taxed pro-rata – partly from your deductible (pre-tax) IRA funds and partly from your non-deductible (after-tax) IRA funds.

“Once you have both deductible and non-deductible amounts in any IRA that you own, including SEP and SIMPLE IRAs, you generally can never take out only the non-deductible amounts. We call this the cream in the coffee rule. Once you put cream in the coffee, all coffee removed from the cup is partly cream and partly coffee.”

The tax preparer fills out form 8606 for Sylvia, and she discovers that of the $10,000 she converted from 2 of her 3 IRAs, only $1,670 of the money she is moving is non-taxable, and $8,330 is taxable.

The bottom line is that the IRS views all IRA assets as one pile of assets. Just remember: when the cream (non-deductible contributions to an IRA) is poured into the coffee (deductible contributions and investment earnings), the IRS can’t tell the difference between the two anymore, and you have to figure out the ratio of cream-to-coffee for tax purposes.

Photo by Christopher Cornelius used under Flickr Creative Commons License.