Recently, I read The Behavior Gap written by Carl Richards, a financial planner and The New York Times columnist. Richards is best known for communicating complex financial concepts using simple back-of-the-napkin sketches.

I enjoyed his winsome way of leaning against the emotional reactions we all have to volatile markets. His self-deprecating approach worked well to communicate some very non-intuitive wealth management principles. Here is an excerpt from the book:

Finding Your Financial Balance

Planning for your financial future is about making trade-offs. It’s largely a question of dealing with the constant tension between living for today and saving for some future event.

What seems like a complicated process (so much so that we often give up before we even start) is really just a balancing act. I’ve found that it helps to put a framework around this process, which we can do by asking a few questions:

- How much can you reasonably save?

- What rate of return will you earn?

- How much do you need?

- And when will you need it?

While these questions may sound simple, they’re not necessarily easy to answer. And certainly there are more questions that you can ask. But these four are pretty central.

Only one of the questions – the second one – has to do with investments. Yet so much of our anxiety about money revolves around that projected rate of return.

Rate of return is only one relatively small part of the equation. The pursuit of higher investment returns may make a positive difference in our outlook, assuming things go as we hope. But there are other things you can do that are more certain – you don’t have to rely on hope – and just as effective. Save a little more if you can. Consider retiring a little later or pursuing a second career.

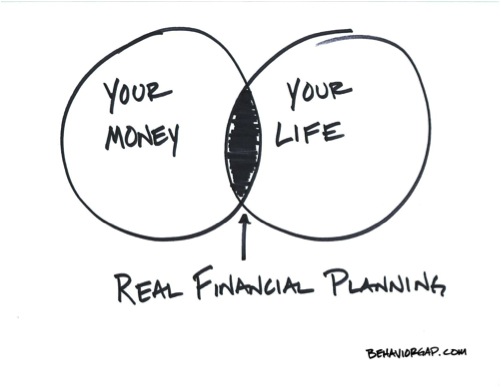

Planning for your financial future is a balancing act rather than a single-minded pursuit of the highest return. Real planning requires thought, frequent course corrections, and, above all, an effort to keep things in balance. Finding that balance is a different process for everyone

For most investors, following the market’s volatility does not bring peace of mind. The Behavior Gap provides helpful advice on how to manage our emotions.