I am trying to pick bond funds for my portfolio. The bond funds you have recommended recently don’t have a very high yield. Why don’t you select a high yield bond fund?

A bond is loan to a company or municipality in which the entity receiving the money agrees to pay interest on the loan twice a year and finally to return the principle after a given number of years. For example, a $10,000 bond paying 5% interest would pay $250 every six months until the principle is finally due.

Bonds are rated by credit rating agencies based on their likelihood of defaulting on the loan and failing to pay part or all of the interest or principle. Bonds which have a very good chance of making payments are called “investment grade” bonds. Bonds with a low credit rating have a higher chance of defaulting on their payments. Bonds that have a higher-than-normal chance of defaulting are called “junk bonds.”

Bond pricing varies based on several different characteristics about the bond, one of which is the rating of the entity issuing the bond.

Given a choice between two bonds with identical terms, investors are willing to pay full price for a bond with a high credit rating but want a discount on the price when they purchase a bond with a lower credit rating. For example, investors might only be willing to pay $7,000 for a $10,000 face value bond paying 5% interest if the company that issued the bond has an above-average chance of defaulting and paying less than its face value.

When a bond can be purchased at a discount, its effective yield is greater than the face value written into the terms of the bond. For example, a ten year bond whose face value is $10,000 and is paying 5% on that $10,000 but which was purchased for only $7,000 yields much more than 5% as it matures. The current bond yield is 7.143% (payments of $500 a year divided by the purchase price of $7,000). At the end of the ten years, the investor will receive the $10,000 face value of the bond, an extra $3,000 over what the investor purchased the bond for. If you factor in that extra payment at the end, a more complex calculation, the bond’s yield to maturity is a whopping 9.851%.

Of course, this assumes that the company doesn’t default on the bond and the investor doesn’t get their money back at all.

This extra interest is why junk bonds are also called “high-yield” bonds. The yield is high only because the bond can be purchased at a discount since there is a good chance of default.

We don’t recommend these bonds because they do nothing good for your overall portfolio.

You should allocate 5-7 years worth of withdrawals from your portfolio to a safe store of value. This part of your asset allocation is priceless because it will allow you to stay invested in stocks during market cycles. This usually means bonds because they return more than cash will. It is a mistake to choose high-yield bonds for this portion of your portfolio because while they might net more money, using them deliberately injects an unnecessary amount of volatility into what is supposed to be the stable part of your portfolio. This is the same principle that discourages gambling with the money earmarked for your mortgage payment.

Correlation is a measure of how closely connected the performance of two sets of investments is. Components of your portfolio should have a low correlation with each other to give you the best chance of having your portfolio do well no matter what section of the market is having trouble (and one always is).

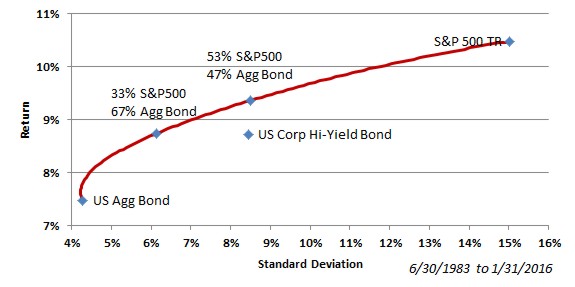

An analysis of several indices (the S&P 500 Composite Total Return, the Barclays U.S. Aggregate Bond Index, and the Barclays US Corporate High Yield Bond Index) from 6/30/1983 through 1/31/2016 show the dangers of high-yield bonds.

The correlation between the S&P 500 and the Aggregate Bond Index was only 0.15, but the correlation between the S&P 500 and the Corporate High Yield Bond Index was 0.58. Since high yield bonds move more in sync with stocks, they provide diversification than non-high yield bonds. The S&P 500 mixed with the US Aggregate Bond Index has a higher average return and lower volatility.

This chart shows the mean annual return and average standard deviation for all three indices as well as two blended portfolios. The mix of S&P 500 and Aggregate Bond bows outward (up and to the left) because its underlying investments’ correlation is low. This means that a portfolio which uses them instead of high yield corporate bonds is on the efficient frontier. These blended portfolios have a higher mean return, a lower standard deviation, or both.

Bear in mind that if you were invested in one of the blended portfolios, your stock and bond investments would each move separately. Only when you looked at the portfolio as a whole would you experience the blended results.

We recommend keeping your bond investments safe to support withdrawals for the next 5-7 years and investing the remainder in stocks where you should experience a higher average return than high yield bonds.

Photo used here under Flickr Creative Commons.