If you are interested in giving large gifts to family members or friends, it is important to know how much you can give without incurring a tax penalty. In 2017, the limit one person can give another person, also called the annual gift exclusion, is $14,000. If you want to give money to a child or grandchild and you are married, each spouse can give a gift of $14,000 for a total of $28,000. And if you are married and the recipient is married, both donors can write checks to both recipients of $14,000 each, for a total of $56,000.

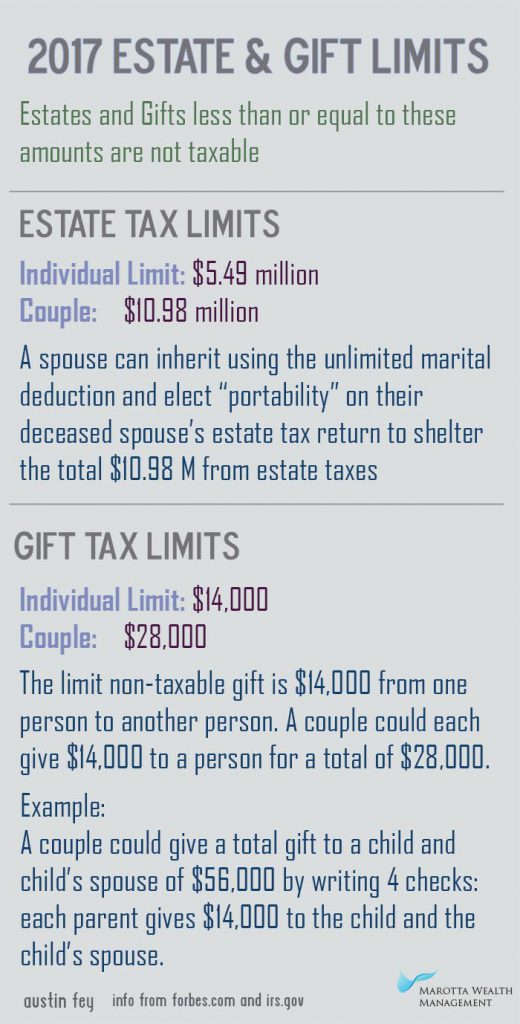

If you are interested in giving large gifts to family members or friends, it is important to know how much you can give without incurring a tax penalty. In 2017, the limit one person can give another person, also called the annual gift exclusion, is $14,000. If you want to give money to a child or grandchild and you are married, each spouse can give a gift of $14,000 for a total of $28,000. And if you are married and the recipient is married, both donors can write checks to both recipients of $14,000 each, for a total of $56,000.

Neither party has to pay taxes on gifts in amounts up to this gifting limit, and the limit remains unchanged from 2016.

If you give a gift above $14,000, you may need to fill out a tax form, and you start to cut into your lifetime gift tax exemption amount. This means the amount above $14,000 will reduce the amount of your estate you can give away at your death free of US Federal tax.

The limit of an estate that can be transferred without paying taxes in 2017 is $5.49 million per individual. You can, however, leave an estate of any size to a spouse under the “marital deduction,” if you and your spouse are both US citizens. If you and your spouse together have a large estate, you can shelter up to $10.98 million between both of you, as long as you select the “portability” option on estate tax form of the first spouse to die. Even if there is no tax due, you should still file an estate tax return with this option selected.

The estate tax limit is up slightly from the 2016 limits, which were $5.45M for an individual and $10.9M for a couple.

Photo used under Flickr Creative Commons license.