Some states do not tax their residents on income from a mutual fund that was earned on U.S. government obligations. This includes income from U.S. Treasury bills, notes bonds, and savings bonds. It also includes a percentage of dividends and interest paid by mutual funds, exchange-traded funds, and money market funds which hold U.S. debt obligations.

In 2016, only 0.92% of the Schwab Money Market Fund’s interest came from U.S. debt obligations. On the other hand, 99.69% of the dividends and interest of the Schwab Short-Term U.S. Treasury came from U.S. debt obligations. For each fund, the appropriate percentage of the dividends and interest paid during the year is deductible on many state tax returns. Funds publish these percentages at the end of each tax year on their websites.

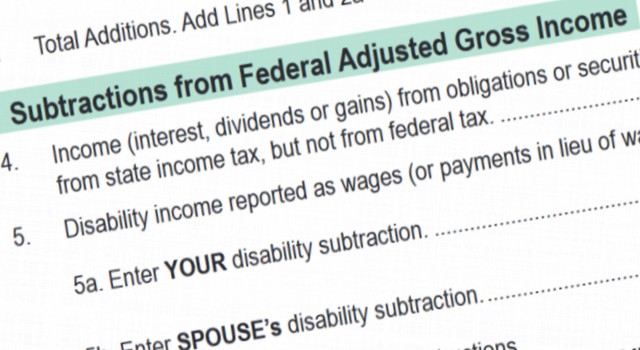

If you are a resident of or file taxes in Virginia, the deduction is taken on line 4 of the Virginia Form 760 Schedule ADJ. That line reads, “Income (interest dividends or gains) received while a Virginia resident from obligations or securities of the U.S. exempt from state income tax, but not from federal tax.”

The instructions for Form 760 clarify in the section on Schedule ADJ:

Line 4. Obligations of the U.S.

Enter the amount of any income (interest, dividends and gain) from obligations of the U.S. that are included in your federal adjusted gross income, but are exempt from Virginia state tax.

Income from obligations issued by the following organizations IS NOT taxable in Virginia: Tennessee Valley Authority, Federal Deposit Insurance Corporation; Federal Home Loan Bank; Federal Intermediate Credit Bank; Governments of Guam, Puerto Rico and Virgin Islands; U.S. Treasury bills, notes, bonds and savings bonds; Federal Land Bank; Federal Reserve Stock; Farm Credit Bank; Export-Import Bank of the U.S.; U.S. Postal Service; and Resolution Trust Corporation.

Income from obligations issued by the following organizations IS taxable in Virginia: Federal Home Loan Mortgage Corporation, Federal National Mortgage Association, Government National Mortgage Association, Inter-American Development Bank, and International Bank for Reconstruction and Development.

If you live in or file taxes in another state, check with your accountant to verify what can be deducted. Most states do not impose income tax on interest income derived from their own municipal obligations. These calculations can make the amount deductible for funds which specifically hold municipal bonds differ from state to state.

Interest and dividends paid in early January often are coded such that they count as part of the prior tax year. Interest and dividends paid in trust accounts may be deductible on the trust tax return or they may pass through the return to the beneficiary’s tax return.

The U.S. tax code and its associated interpretations, case law, and explanatory documents are a massive and complex set of rules. With its great complexity come great opportunities for tax savings. Some opportunities, such as Roth conversions, offer potentially very large savings. Others like this opportunity are smaller but still significant.

Many investors will have few or no bonds in their taxable account. Tax savings can be gained by locating different assets in different types of accounts. Bonds are best located in traditional retirement accounts such as traditional IRAs or traditional 401(k)s. Investors who can take advantage of the tax savings associated with asset location may not have any interest and dividends from U.S. debt obligations.

But if you have a significant taxable account which holds bonds or bond funds, you might receive as much as $4,000 in interest and dividends from U.S. debt obligations. At Virginia’s income tax rate of 5.75%, that deduction would be worth $230. It would be a shame to lose this money when you could otherwise keep it simply because you did not know you could keep it.

Photo from Virginia Form 760 Schedule ADJ.