I started listening to podcasts at night before going to sleep. In the process of browsing for interesting ones, I listened to a podcast called “Adam Ruins Everything.” The premise of the TV show by the same name is that Adam Conover, a self-described investigative comedian, tries to uncover the hidden truths behind everyday false beliefs. In the podcast, he chats with various experts to the same end.

I started listening to podcasts at night before going to sleep. In the process of browsing for interesting ones, I listened to a podcast called “Adam Ruins Everything.” The premise of the TV show by the same name is that Adam Conover, a self-described investigative comedian, tries to uncover the hidden truths behind everyday false beliefs. In the podcast, he chats with various experts to the same end.

I listened to “Adam Ruins Everything Episode 43: Professor Teresa Ghilarducci on the Future of 401(k)s ” with great interest.

I’m thankful they talked about saving 15% of your take home pay, avoiding excessive fees, and delaying Social Security, all of which are very important. They also talk about how the pay-as-you-go system of Social Security is not successful, although Ghilarducci is still a little rosier than I would be.

However, for a show trying to turn over common falsehoods, I was disappointed by how many misleading opinions, implied errors, and outright mistakes were in the episode.

Is Funding a 401(k) Sufficient?

At 11 minutes in, Adam asks, “If I do this [fund my 401(k) to get the match] for the rest of my working life until I’m 65, so another 30 years, is this really going to do the trick? Can anyone tell me if this is going to work?” Ghilarducci promises to answer that question in a minute, but forgets to circle back. The closest she says is “Your story, Adam, could turn out well.”

I understand how difficult it is to answer a retirement planning question like this on the air, but I also would have hoped that she had done the math before going on the air. Here’s our 2014 article answering that question: “Mailbag: Is Funding My 401(k) Match Sufficient to Fund My Retirement?” which says that saving 5% of salary to get a 4% match will have only funded 64.2% of your retirement. In other words, it is not enough. Instead, we say, that you need to save 15% of your take home pay with as much of that as you can in a Roth IRA or Roth 401(k).

Instead of answering the question, Ghilarducci and Adam talk for 10 minutes about how Adam is “lucky” that his privilege “allowed him to save.” But privilege does not help you save. Saving is not a passive luck that some are graced with and others just hope for. Frugality is a lifestyle choice. It is the hard effort of budgeting, doing without, and in general being nice to your future self. We call thrift a virtue, in part, because it is an ideal to be pursued like patience or humility.

Neither savings nor the diligence to save falls into your lap. Just look at those who do experience windfalls: 70% of lottery winners and 1 in 6 football NFL players end up bankrupt despite their millions. There is effort, more than luck, involved in saving.

It does a disservice to those that are not saving to imply that they are unlucky and thus might not be able to save. And it is insulting to those who are saving to imply that their sacrifice and effort is mere luck rather than the merit of developing and encouraging their virtues.

Can a Retiree Survive a Financial Crisis?

At 20 minutes, Adam says, “The truth is that… someone retiring in 2008 would be screwed by that [ the 401(k) ] system” and Ghilarducci just passively agrees.

Many people around my age or younger seem to think that the financial crisis of 2008 was the worst thing that could happen to retirement, but that is simply not true. The “worst” historical market is of course retiring in October of 1968. A retiree at the end of 1968 has to survive not just the double digit inflation of the 1970s, but also the The Baby Bear Market of 1966, The Double Bottom Bear Market of 1970, The Golden Bear Market of 1973, and Volker’s Bear Market of 1982. Retiring at the end or around 1968 is the most stressful retirement stress testing that can be done.

So let’s do both stress tests: retiring in October 1968 and retiring in October 2008.

Imagine a person working from age 25 to 65 (40 year working career), saving 15% of their $50,000 take-home pay, retiring at age 65, and living off just their savings from ages 65 – 95 (30 year retirement). In each scenario, the person saves $625 each month while they are working and spends $3,542 each month throughout.

I give them our recommended age-appropriate Stability-Appreciation asset allocation. Historical data going back far enough can be hard to find. I use the oldest bond fund for Stability: the Putnam Income Bond Fund A which has data from 1954 onward. For 1928 – 1954, I use a 0% return for Stability. For appreciation, I use the S&P 500. From 1970 onward, I can use the S&P 500 Composite Total Return, but for 1928 – 1969 I use the S&P 500 Price which has lower returns because it does not include dividends.

For all returns, I inflation adjusted them downward by the U.S. Consumer Price Index where available (which is 1970 onward).

When I need future returns (those after June 2018), I wrap around my data and have them experience the inflation-adjusted returns of 1930 onward with 0% for Stability.

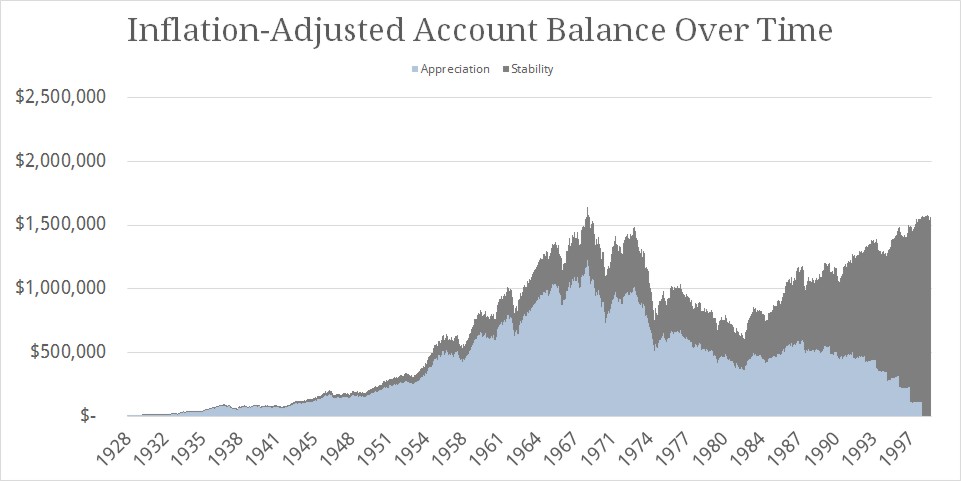

Scenario 1 is working and saving from 1928 to 1968 and then retiring and withdrawing until 1998. Here is the graph of Scenario 1’s asset allocation and net worth over time:

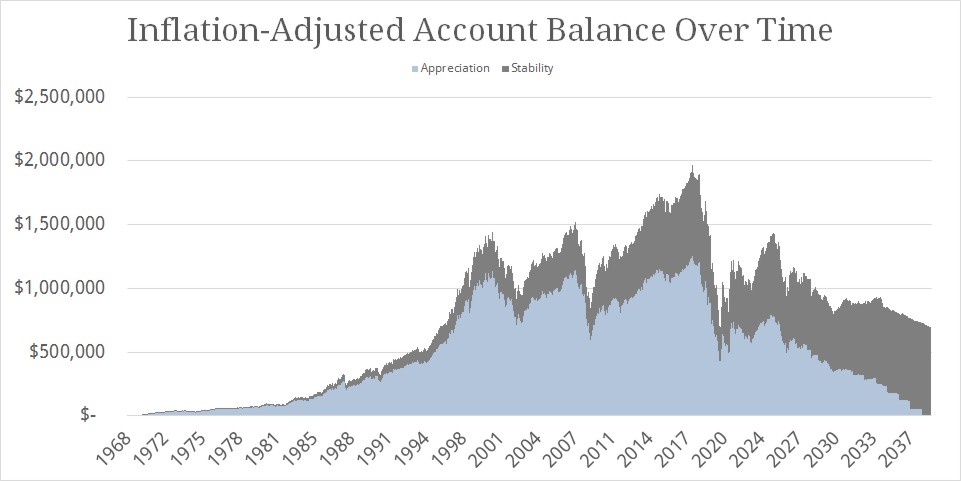

Scenario 2 is working and saving from 1968 to 2008 and then retiring and withdrawing until 2038. For the future returns of 2019 – 2038, I use unfavorable returns of the S&P 500 Price (no dividends) in 1930-1950 for Appreciation and 0% for Stability. Here is the graph of Scenario 1’s asset allocation and net worth over time:

As you can see, even in these two “worst case” scenarios, the retiree is successful in meeting their withdrawal needs. At the end after 30 years of withdrawals, the retirees have $1,528,595 and $696,946 leftover in the actual data of Scenario 1 and the theoretical data of Scenario 2 respectively.

Now these are obviously just thought experiments, but they do help combat the narrative of Adam and Ghilarducci. You probably won’t “be screwed” if you “do everything right.”

Do You Have to Do It Yourself?

At 24 minutes, Ghilarducci says, “We forced every worker to be a financial expert. …It is as if we’ve told people that they have to do their own dentistry or their own electrical wiring…”

Asking someone to brush their teeth doesn’t mean that they must go without the advice of a dentist.

Asking someone to flip their own circuit breaker switch doesn’t mean that they must go without the help of an electrician.

In the same way, asking someone to save for their retirement doesn’t mean they must go without the help of a financial planner. If you are looking for help, take a look at “How To Find A NAPFA-Registered Advisor In Your Area” or check out how to get started with our services.

Do Percentages Help Higher Income People?

Minutes later, Ghilarducci goes on to say:

It is also so unfair if we build a retirement system that only caters to… higher income people because they are the ones who have the money to voluntarily save. …Your HR director says, “Hey, do you want to contribute 1% to 8% to 10%?” Well, if you are a higher income person, you are going to have more income to save.

First off, no one just “has more income to save.” Anyone’s lifestyle can grow to fill their income. Basically no matter what amount you make, there is someone spending every penny of a salary five times your size and someone saving more than you on an income half yours. It takes diligence to keep spending low and saving high.

Second, if both the higher income and lower income person are saving the same percentage, they are going to be in the same struggle when retirement comes around.

Let’s imagine that both a higher income person ($100,000) and lower income person ($50,000) save 10% of their income. They both spend 90% of their income to support their lifestyle, but for the higher income person their lifestyle is $90,000 per year while the lower income person has a lifestyle of $45,000 per year.

In order to continue that lifestyle in retirement (“the basic dignity of staying in their house” as Ghilarducci would say), they will need to have different amounts saved. To support their safe withdrawal rate when retiring at age 65, the higher income person will need $2,064,220 saved while the lower income person will only need $1,032,110 saved.

The higher income person has the same problem but twice the difficulty to solving it. While the lower income person only needs to cut $2,500 out of their spending to save the recommended 15%. The higher income person needs to cut $5,000 out of their spending to save the recommended 15%. And cutting even $100 out of an annual budget can be tricky and difficult.

Is the Benefit of Retirement Contributions Progressive?

Ghilarducci continues her rant against the wealthy into her biggest mistake of the episode. She says:

…our tax system is built for a deduction for retirement savings. The more money you make; the more money you get back from the government for saving. So you could be doing all the right things making $25,000 per year, save maximum, … but since you only put in the standard deduction, which most tax payers do, you don’t get a cent from the tax preference for retirement savings. It is only people who are making $70,000 up to $250,000 that really get a substantial, what I call, subsidy or tax break from the federal and state governments. So we’ve really built a system that really helps the higher income people.

To which Adam responds, “That is a good point,” but anyone who has looked at a tax return is shocked that Ghilarducci is considered an expert with this level of misunderstanding.

First, funding your traditional 401(k) is not a deduction at all; it is an exclusion. This means each dollar you put into your traditional 401(k) is excluded from IRS reporting entirely. If you fund your traditional 401(k) for $10,000, your W-2 from that employer will be $10,000 lower than you actually made. This is true for everyone, high income and low income, regardless of anything.

When Ghilarducci says that there are people who “don’t get a cent from the tax preference for retirement savings,” she is simply wrong. There is no qualification that Ghilarducci could add that would make her statement correct.

Second, if we allow her to be talking about the traditional IRA contribution deduction (which would be surprising as Adam was the only one to even say the word IRA), she is still wrong. The traditional IRA contribution is not an itemized deduction but rather it is an “above-the-line” deduction. This means that regardless of if you itemize or take the standard deduction, you get the traditional IRA contribution deduction.

Furthermore, wealthy people are actually phased out from being able to take the traditional IRA deduction based on their AGI. This makes the exact opposite of Ghilarducci’s point true. Here are the edits in bold that would make her statement true: “So you could be doing all the right things making $250,000 per year, save maximum, … but since your contribution deduction is phased out, you don’t get a cent from the tax preference for retirement savings.”

Are Annuities the Right Answer?

At 35 minutes, the conversation goes like this:

Ghilarducci: What do you do when you are 65 and you have this big lump sum, say you have $600,000, and the market crashes then, and you lose 30% of that $600,000.

Adam: Like it did in 2008.

Ghilarducci: Yeah, and you did everything right! But yet that shock — so we need a system that turns that lump sum and makes it immune from whatever is happening at the time in the financial crisis but also lasts your whole lifetime. It is paid out in what is called an annuity, a lifetime stream of income for the rest of your life.

An immediate annuity is not an investment. Any salesman who represents an annuity as an investment or pretends that the payment is a return on your investment is being fraudulent. It is an insurance product. It is purchasing up-front the right to collect a fixed amount of income from the insurance company for the rest of your life.

When thinking about annuities, most people fail to take into account the immediate loss of 100% of your principal. Buying an annuity is like purchasing any other insurance policy: the only thing you own is a contract. The cost of the annuity is no longer yours. The insurance company now owns it. You lose ownership of 100% of your assets and any proceeds you could have gotten from those assets the moment you sign the annuity contract.

That is a high price to pay just because you are afraid of the markets. The markets are inherently volatile but they are also inherently profitable.

Using a sample annuity, the insurance company simply hands you back your own money for 16 years and 8 months, so the “return” on your investment for that time is actually negative.

Again, Ghilarducci is wrong here. An immediate annuity is probably never the right answer.

Should we force people to save?

At 42 minutes, Ghilarducci says the retirement options are “Do you want to work longer, pay more taxes, or be mandated to save?”

And later at 59 minutes, Adam says, “Some problems are not solvable on an individual level. …Even if you do everything right, you can’t guarantee retirement. … It is a problem that needs to be solved collectively. … ‘Learn to cure your own diseases.’ No! At the end of the day, you all need to band together and build a hospital.”

In both comments, the speakers are suggesting that maybe people are not capable of saving for themselves and we should force them to do it.

This comes straight from the Helicopter Government way of thinking. The progressive agenda asks the government to intercede (or interfere) on the public’s behalf at many moments of conflict, discomfort, or uncertainty. Many parts of life require responsible decisions. Failure to do so creates predictable negative consequence. To save the public from those consequences, progressives ask the helicopter government to intercede for our behalf.

They call for universal health insurance in Obamacare and Medicare, universal retirement pensions in Social Security, and universal schools in the public school system. They call for hundreds of welfare programs to protect us from bad financial consequences.

What is more, sometimes it is our own decisions that are bad for us. Then, the helicopter government has to turn to control. If they won’t freely choose this, we’ll just have to force them. They propose a ban on sugary drinks, make biking without a helmet illegal, and place a punitive tax on tobacco.

But the person who tortures you for your own good will never stop. They will never admit that it is torture. They will never shy away from hurting you more.

Confiscating someone’s money to force them to save may harm them. As a general rule, I believe that people should save 15% of their take home pay in order to be on track for retirement, but I can easily imagine individuals who do not need to save this much or even do not need to save at all. Just as easily, I can imagine individuals who have a financial situation where forcing them to save now may cause real financial hardship without adding additional responsibility.

It takes a lot of arrogance to think that you can create one rule that is financially best for every individual in the country. I have the humility and wisdom to know that you cannot even do that for 200 families. Our clients’ financial situations are very similar by any census data statistic, but the advice we give to each of them is extremely diverse. Even among clients we are recommending a Roth conversion to, the specifics of the recommendation are completely different and customized.

Adam uses the analogy that “At the end of the day, you all need to band together and build a hospital,” to justify his claim that retirement “is a problem that needs to be solved collectively.” However, our proverbial hospital has already been built; it is called Mutual Funds and Exchange-Traded Funds.

Before these funds, you had to either take your luck at individual stock selection or invest in only bonds. Now, there are companies, like Vanguard, which do the hard work of curating the list of all the publicly traded companies of the world into funds tracking various sectors or indexes making investing simple and easy for the average person. Then, on top of that, there are investment firms, like ours, which are here to help if you need it.

You don’t have to “cure your own diseases.” You don’t have to plot your own course to retirement. You don’t have to design your own asset allocation, You don’t have to do these things alone.

There is still more that I could comment on in this episode, but I will stop here. With this many mistakes on a topic that I know a lot about, I worry that “Adam Ruins Everything” will have just as many mistakes when covering topics I don’t know as much about only I won’t be able to know where he is misleading me. As a result, I do not recommend this podcast.

I’m glad that they did cover so many good topics (saving 15% of your take home pay, avoiding excessive fees, and delaying Social Security), but overall I wish that they’d had a greater internal locus of control and emphasized personal responsibility instead of dependence.