By default, most of us would make impulsive purchases. We see it, we want it, and we purchase it. There is a satisfaction in satisfying the need quickly.

By default, most of us would make impulsive purchases. We see it, we want it, and we purchase it. There is a satisfaction in satisfying the need quickly.

Estimating 40% of a typical family’s purchases are made with insufficient thoughtfulness and that family’s annual budget is $60,000 that would mean they might be mindlessly spending about $24,000 a year or as much as $2,000 a month. Assuming that a typical household averages 3 purchasing decision each day and 40% of them are ill-considered, they could have as many as 8 opportunities each week or 438 per year for more intentional spending. That is great deal of potential to increase the efficiency of a household’s income.

Wealth is what you save and invest, not what you spend.

Every purchasing decision is an opportunity to save. There are dozens of principles that can be applied to our spending habits to help us make good decisions.

Anything that can slow the purchasing process gives us a chance to stop and evaluate alternative ways that a need can be dealt with more efficiently or more effectively. This leads to better purchases.

That’s why much of learning how to spend is learning how to not spend quickly or mindlessly. Learn to do without. Instead of buying, take a photo. If you still really want it, wait a week. After waiting a week if you don’t need it now, add it to your wishlist for someone else to get you. These are all strategies for silencing an impulsive desire long enough that you can assess if you really want it for the price it is listed.

Since impulse purchases are mindless, anything that causes us to stop and notice the fact that we are making a purchase can be helpful in breaking the process. Additionally, any contentious reflection on what triggers us to make mindless purchases is also helpful in breaking the cycle.

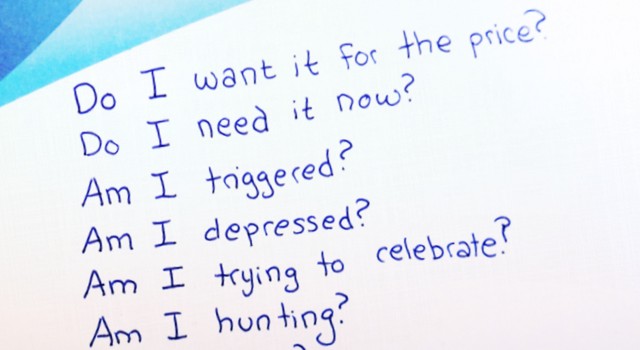

Here are some questions to help you identify when you are susceptible to making an impulse purchase:

Do I want it for the price it is currently listed? Sometimes it is easy to identify that you want an item, but do you want the item for the price it is currently listed. If you don’t want it that much, don’t buy it.

Do I absolutely need to make this purchase right now? If not, don’t buy it now. Make a list of things you want to purchase. Simply separating the thought of purchasing something from actually purchasing it will avoid many mindless purchases. After making a list, take the time to use the principles in the rest of this series to explore how to spend less money.

Am I experiencing a trigger that causes me to spend money? A trigger is any stimulus that causes us to feel or behave a certain way. Spending money often has triggers associated with it. For example, hungry people have a tendency to spend more at the grocery store, are more likely to pay extra to eat at or from a restaurant, and often make more expensive meal plans. Remove the trigger (eat something) and try again.

Are you shopping to elevate your mood? This is a very common form of overspending. There is a high that can be obtained simply by shopping and purchasing something. This shopper’s high can be triggered even by seeing photos of things that you would like to own. We are often willing to give up something abstract (like money) in order to get something that is immediate and tangible.

Are you shopping to celebrate something? People who reward themselves by eating are often overweight. People who reward themselves by spending are often poor.

Have you finally found something that you have been hunting for? Sometimes the thrill of the hunt causes us to look to an item that we don’t really want to purchase or don’t really want to purchase for the price it is currently listed. If you have become overly invested in finding something, it may be time to slow down and consider alternatives rather than purchasing the only example you have found.

Are you bidding on it? If so, you should aim to be biased toward walking away. If you aren’t willing to walk away or are anxious you might lose the bidding, you will pay a premium for your purchase. Humans are very competitive. You can go broke trying to win bidding wars. You will never go broke because someone else was willing to bid more.

Is the supply limited? If so, you may be paying too much for it. Several sites automatically adjust the pricing as the inventory gets low. This guarantees you will be paying more than you should. Patience is required for your purchases to be wise and thoughtful. Humans have a great loss aversion and marketers use this emotion to drive us to purchase items by advertising that the supply is limited.

Is it “on sale”? If you did not plan to purchase it, don’t purchase it just because it was on sale. Stores are notorious for normally selling an item for $15 only to mark it up to $40 during a 50% off sale. There are no deals that are too good to pass up. No one ever went into credit card debt by failing to buy things when they were on sale.

Am I in an environment that encourages spending money? Hanging out with your friends in shopping centers or at coffee shops can often lead to impulsive purchases.

Have I seen advertising encouraging me to spend money? Although it is true that advertising can help you find things you really do truly want, normally they are also very persuasive and manipulative. If you’d recently seen an advertisement for the item you want to buy, wait a week without seeing an ad and then see if you still want it for the price it is listed at.

Am I paying for convenience? Salads are easy to make. Put greens in a bowl. Chop some toppings down to size and put them in the bowl. Top with a dressing. Prepared salads are even easier to make. Buy salad. The price difference between the two is very noticeable. For the prepared salad, the extra charge pays for convenience. It’s okay to pay for convenience, but you should consciously acknowledge that this time the convenience is worth it.

Stopping to think through questions like these will likely help you make smarter decisions with your spending.

Photo by author