I recently turned 26 and rolled off my parent’s health insurance plan. Shopping for health insurance is tedious, but I was excited to be able to open my very own Health Savings Account.

I recently turned 26 and rolled off my parent’s health insurance plan. Shopping for health insurance is tedious, but I was excited to be able to open my very own Health Savings Account.

Health Savings Accounts (HSAs) are a favorite of ours because you get an above-the-line tax deduction for contributing regardless of whether or not you itemize. Furthermore, the assets are able to grow tax-free so long as they are ultimately used for qualified health expenses. It is like getting the best of both worlds between traditional and Roth IRA contributions.

We recommend that if you are eligible for an HSA, you prioritize funding it to the maximum allowed each year. In 2021, this maximum amount is $3,600 for individuals and $7,200 for families (up from 2020 by $50 and $100 respectively).

The additional allowed catch-up contributions for those over the age of 55 is $1,000, which has remained unchanged since 2009. Both spouses participating in a family plan are eligible for the catch-up contribution.

There are many choices for an HSA custodian. One good option is HSA Bank because it allows you to custody funds for investment at TD Ameritrade.

Unfortunately, there are many steps required to open, contribute, and transfer funds to TD Ameritrade.

Interestingly, while you are required to have a High Deductible Health Plan (HDHP) in order to contribute to an HSA, HSA Bank did not verify that I was enrolled in the correct type of health plan. The burden for knowing whether you can contribute relies only with you as the participant.

The first step in the process is to apply for an account with HSA Bank. You can do so online by going to their website https://www.hsabank.com/.

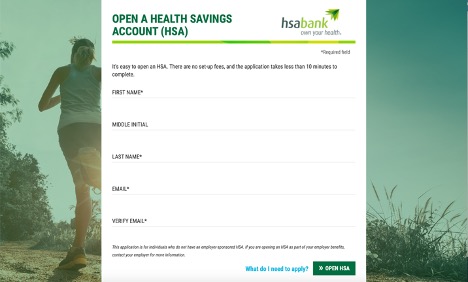

Once on their website, you can click the blue link in the upper right-hand corner “Open an HSA.” You will then get a pop-up window which begins the application:

Fill out the requested information.

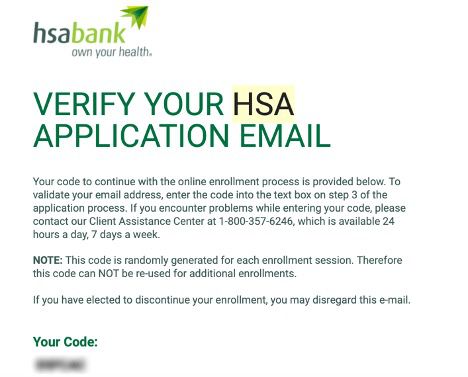

After filling out your information, you will be asked to verify your email address. HSA Bank will send a verification code to the email address on your application and you will need to enter that code back on the application before you will be able to submit the application for processing. The email looks like this:

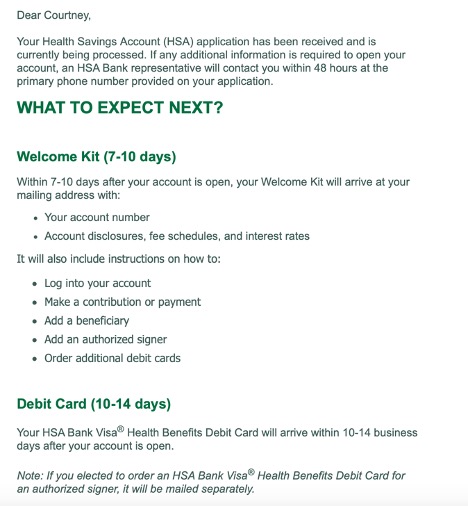

After verifying your email, your application will be submitted to HSA Bank. You will receive an email from HSA Bank documenting that your application has been received and notifying you of the next steps:

After verifying your email, your application will be submitted to HSA Bank. You will receive an email from HSA Bank documenting that your application has been received and notifying you of the next steps:

It took about 10 days for my welcome kit to arrive in the mail.

Once the welcome kit with your account number arrives, you can create your online account by clicking “Log In” on the HSA Bank’s main webpage. On the page that loads, scroll down to select “Create username and password” under the heading “New User?”

As part of this account creation, you will be asked to verify information like your name, social security number, and birthday.

Photo by Rachel Martin on Unsplash