In 2004, I wrote the article “Long-Term Care Insurance Is Too Risky And Too Expensive.” Since then, the article has been quoted by many different financial advisors in defense of self-insuring for long-term care health expenses. The idea of self-insuring was vaguely to set aside a pile of money in case of long-term care needs. For younger people this amount was $100,000 and as you got older the amount was closer to $250,000. In 2020, I wrote “How to Self-Insure for Long-Term Care Health Expenses” which provided specific amounts to set aside at specific ages.

While specifying a dollar amount provides clients with accuracy, keeping those dollar amounts up to date in this inflationary environment requires an up-to-date study on the cost of care. Additionally, long-term care costs are dependent on your location within the United States.

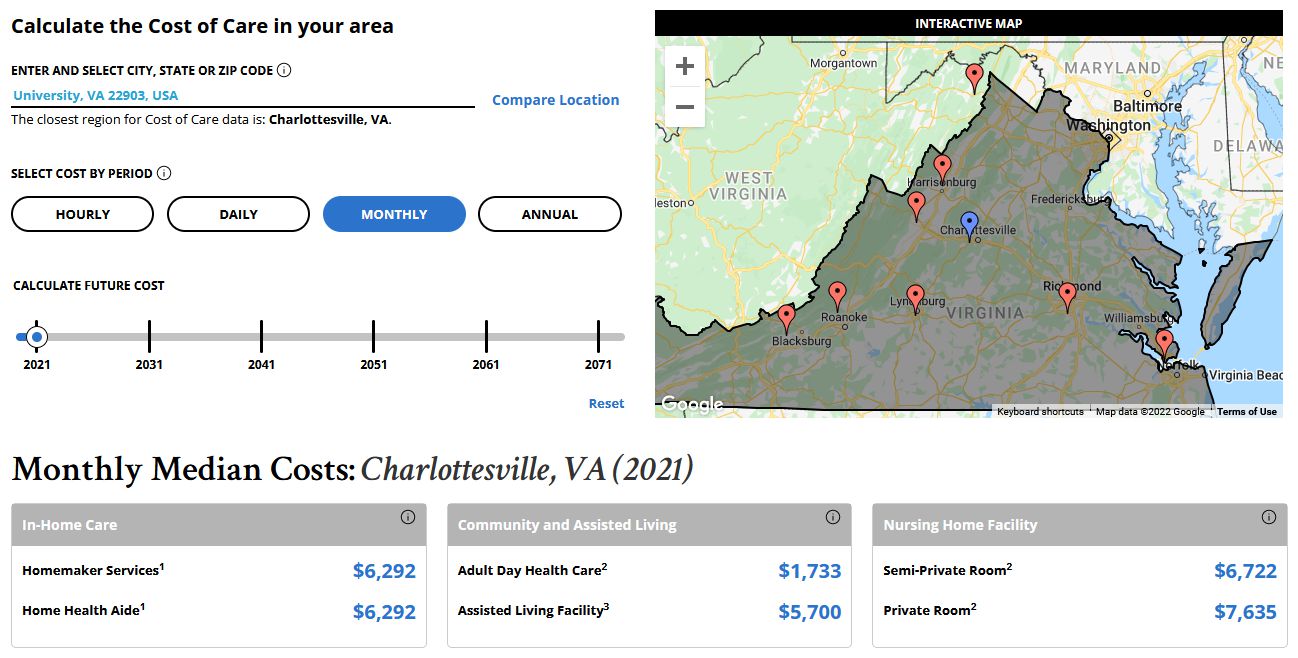

Fortunately, Genworth does an annual study which they have published online as the “Cost of Care Survey.”

There you can enter your nearest location and it estimates the cost of various levels of care.

With this level of detail, choosing how you want to self-insure for long-term care is more easily accomplished.

Genworth is an insurance provider. They have released this study to encourage you to purchase long-term care insurance. However, we are very thankful that they have released this information freely for everyone to use. Their readily accessible data makes customizing how much you want to save for long-term care costs much easier.

For more information about how to self-insure for long-term care, read “How to Self-Insure for Long-Term Care Health Expenses (2022).”