Johnson & Johnson has a product presence in both the Consumer Staples and Health Care sectors. To separate those two interests, they are splitting off a new company called Kenvue to hold their Consumer Staples products while retaining their Health Care products under the Johnson & Johnson company.

If a corporation is recommending an action, it typically isn’t in your best interests. This action from Johnson & Johnson is fairly neutral. We recommend ignoring this offer if you want more Health Care and taking this offer if you want more Consumer Staples.

What is the offer?

Earlier this year, Johnson & Johnson (JNJ) established a new company named Kenvue (KVUE) to hold most of its consumer health products. Consumer health products are medicine available over the counter and considered part of the Consumer Staples sector.

In the current offer, JNJ has proposed exchanging their shares of Kenvue common stock for their shareholder’s shares of Johnson & Johnson common stock. Presently, JNJ owns 89.6% of the total outstanding shares of Kenvue common stock and has proposed exchanging 80.1% of the total outstanding shares in this offer. As a result of this exchange, JNJ’s ownership of KVUE will be reduced to less than 10% of the total outstanding shares.

Your decision on this offer must be made by August 14th, 2023. You decide by providing your instructions to your custodian.

What should I do?

The exchange offer made by JNJ is considered a “split-off.” In a split off, the shareholder decides if they want to own the parent company, the newly formed company, or a combination of the two. In this case, if shareholders take no action, they will retain their JNJ shares. If the offer receives more responses than anticipated (called “oversubscribed”), all of your elected shares might not be exchanged.

In the 2022 annual statement, JNJ reported revenue sources as follows:

- 55.4% ($52.6 billion) from pharmaceutical sales, (considered Health Care)

- 28.9% ($27.4 billion) from medical device sales (considered the Health Care), and

- 15.8% ($15.0 billion) from consumer health products (considered Consumer Staples).

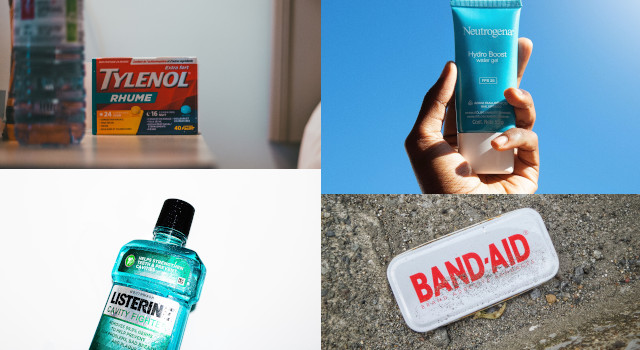

Recently, JNJ created Kenvue through a small IPO to own the consumer health products. Those products include Aveeno®, BAND-AID® Brand Adhesive Bandages, Lubriderm®, Nicorette®, Rogaine®, Desitin®, Johnson’s®, Listerine®, Neutrogena®, Clean & Clear®, Stayfree®, Carefree®, Neosporin®, Tylenol®, Motrin®, Zyrtec®, Benadryl®, and Sudafed®. These iconic brands have an established loyalty with an accompanying revenue stream.

After the split off finishes, Johnson and Johnson will be more exclusively a pharmaceutical and medical device company, solidifying its place as the second largest holding in the Health Care industry. Meanwhile, KVUE just started trading in May 2023 and will likely eventually join Consumer Staples indexes and funds as a Large Cap company.

Both Health Care and Consumer Staples are categories that we actively invest in and offer good prospects for future returns. Historically, Consumer Staples has had a lower expected return but a larger risk-adjusted return than Health Care while Health Care has had a higher expected return but with more volatility than Consumer Staples.

We expect both JNJ and KVUE to perform similar to their sectors. For this reason, we recommend ignoring this offer if you want more Health Care and taking this offer if you want more Consumer Staples.

If you are unsure which you want, we recommend ignoring the offer. This offer has been described as a tax-free exchange, but due to the complexity involved, it is best to consult with a tax professional to review your particular situation. As is often the case with spin offs and split offs, there is the potential class action lawsuits to follow.

Photos by Erik Mclean, Arthur Pereira, Mishaal Zahed, and Possessed Photography on Unsplash. Images have been cropped.