Among the most complicated and frustrating IRA rules are required minimum distributions (RMDs). RMDs are required on all traditional IRAs starting in the year of your required beginning date. For inherited IRAs, RMDs are also obligatory either starting the year after the previous owner’s death or gradually over the next 5 to 10 years.

Among the most complicated and frustrating IRA rules are required minimum distributions (RMDs). RMDs are required on all traditional IRAs starting in the year of your required beginning date. For inherited IRAs, RMDs are also obligatory either starting the year after the previous owner’s death or gradually over the next 5 to 10 years.

A new RMD value must be calculated every year.

Although many companies will determine traditional IRA RMDs for you, the RMD of inherited IRAs is significantly more complex. The inherited IRA calculation is so onerous that account owners or their advisors must compute it manually. Although the client is ultimately responsible, we provide assistance in calculating and implementing our clients’ RMDs, both traditional and inherited, each year as a part of our Comprehensive and Collaborative service levels. We also provide the administrative support necessary to oversee the entire distribution process.

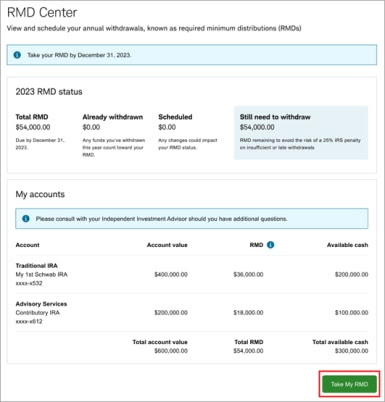

Recently, Schwab released an alert to advisors called “Clients have improved visibility into required minimum distributions (RMDs) through Schwab Alliance.” In the alert, Schwab writes (picture included in the alert):

Starting June 10, we will be rolling out the new RMD Center experience to all advised clients in waves. This new experience gives clients at-a-glance insights into their RMD status for the current year. This view provides distributions at the client level instead of the account level, providing a more holistic overview. They can see:

- Total RMD

- Withdrawals to-date

- Remaining amount that must be withdrawn to meet the annual RMD requirement

- Scheduled withdrawals (retail accounts only)

Clients can access the new RMD Center from the Take my RMD tab on the Accounts page on Schwab Alliance.

Previously, you could see Schwab’s calculation of your RMD by clicking on “Balances,” navigating to the relevant retirement account, and looking at the boxes to the right of the historical balances graph. This strategy of seeing your RMD still works.

Under the new RMD center, Schwab says you will be able to see your RMD by clicking on “Take My RMD” under Accounts, by navigating to the direct link Schwab.com/myRMD, or by going to the RMD Center application home page.

Because the new RMD Center experience is being rolled out in waves, this page will not load for everyone. And indeed, it does not load for our staff, so we aren’t able to preview the page as of the publication of this article.

That being said, the alert includes the following picture (picture quality from Schwab):

Under “My accounts,” the page appears to list each IRA subject to RMDs, the account value (is it December 31 or current?), Schwab’s RMD calculation, and the available cash in the account (presumably currently).

Then under “20YY RMD status,” the page appears to total your RMD from all listed accounts and report on the amount already withdrawn, the amount you have scheduled to withdraw, and the amount you “still need to withdraw” (Is this the short fall between the already withdrawn and the scheduled?).

This new dashboard should provide a lot of visibility and support to clients with required minimum distributions.

One currently unanswered question is: Will inherited IRA RMDs be included on this page? While Schwab has not been able to weigh in on the answer to this question, we would guess that inherited IRAs will be excluded from this page entirely. This may cause some confusion, but likely no more confusion than the owners of inherited IRAs are already used to.

Boxed at the bottom of the image, you can see that Schwab shows a “Take My RMD” button. However, our clients will likely not see this button on their dashboard.

The reason, as Schwab goes on to explain, is that Schwab intentionally turned the feature off for clients working with a non-Schwab advisor.

In a section called “There are two possible experiences for AS clients,” the alert reads:

If your client’s RMD-qualified accounts are all advised, they will see a view-only version of the RMD center. However, if any of their RMD-qualified accounts are unmanaged—that is, retail accounts—your clients will see a version of the RMD center that includes a “Take My RMD” button that will allow them to take distributions from the retail account only.

This means that only Schwab retail accounts — accounts that are not being managed by a non-Schwab financial advisor — are given access to the new distribution feature. What does the new distribution feature do exactly? That is currently unclear. Schwab’s reasoning for reserving this feature for retail clients is because they assume that the advisor on the account has likely integrated the RMD into a larger financial plan and advising clients should collaborate with their advisor to take their distribution. Not a bad assumption, but it would be nice to empower adults with tools.

Also, as noted before in the first part of the alert, Schwab is also reserving the total “scheduled withdrawals” calculation for retail accounts only, implying that accounts manged by a non-Schwab financial advisor will not have this feature. What is the reasoning behind that decision? No reasoning has been provided at this time, so I would assume that the programming was difficult for some reason and Schwab decided they didn’t want to do it.

However, this decision is another in a trend of Schwab limiting the user experience of clients working with a non-Schwab advisor. Based on client feedback and alerts like these, we have gradually learned about the Schwab retail features which Schwab Alliance turns off for our clients by default. Sometimes, we can call Schwab, advocate for our clients, and get them to flip a switch to turn the feature back on. Other times, they haven’t given themselves the capability to turn the feature on for Schwab Alliance.

We have been told that, at this time, Schwab is not able to turn on additional features in the RMD Center for “Advisor Services (AS) clients” (those with a non-Schwab advisor).

We will continue to monitor the new RMD Center and what options our clients have on this page.

For our clients at the Do-It-Yourself service level, this new RMD Center will likely be a welcome addition. For others, this may be a helpful page to supplement the reports we already provide as a part of our Required Minimum Distribution service.

If you have questions about this or other Schwab processes, it is always best to call Schwab Alliance at 800-515-2157 and speak with a Schwab Alliance team member directly.

Photo by Alex Knight on Unsplash. Image has been cropped.