We advise against setting up a monthly recurring required minimum distribution (RMD) to distribute on any day prior to the 5th of each month. In fact, if we had our pick, we would suggest scheduling your RMD for the 8th of each month.

We advise against setting up a monthly recurring required minimum distribution (RMD) to distribute on any day prior to the 5th of each month. In fact, if we had our pick, we would suggest scheduling your RMD for the 8th of each month.

If you want to take our word for it, no need to move on. You can schedule your monthly RMD for the 8th.

If you are curious as to the calendar math that suggests this date, here’s why.

The Facts of the Matter

These facts plus the variability of the calendar create all the complexity.

- At Schwab, your chosen date is treated as the day you want the assets to deposit in the receiving account.

- Withdrawals to another Schwab account (Journals) deposit in the receiving account on the same day.

- Distributions to external accounts (MoneyLinks) withdraw one day before they deposit in the receiving account.

- All withdrawals and deposits must happen on a valid business day.

- No withdrawals or deposits can occur on an observed holiday or on a weekend.

- Schwab’s system automatically moves scheduled withdrawals onto valid business days.

- Withdrawals which occur in a relevant calendar year count as distributions for that relevant tax year.

- You must use the December 31st value of the prior year to calculate this year’s required minimum distribution.

Here’s how these rules create problems around the January 1st banking holiday.

Calendar Math

Example 1: Why Not the 1st of the Month

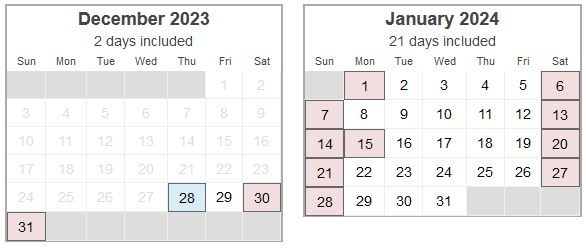

It is easy to construct an example which shows why monthly on the 1st of the month creates a problem. For this example we will use 2024 when January 1st was a Monday, but this example holds true for any weekday.

Because January 1st is a banking holiday, a withdrawal scheduled for the 1st will be moved to the prior business day, which in this example is Friday, December 29, 2023.

Because those distributions would be in the prior year, they would not count towards your 2024 distributions but instead your 2023 distributions. This is useless in your required beginning year. And in later years, this effectively means that, while you still have 12 distributions to fulfill your RMD, the last one, which is necessary to satisfy your RMD, happens on the very last business day of each year.

This leaves no room for mistakes and no chance to fix the problem. And indeed, if a mistake does happen, you may have muddled two RMDs, corrupting both your 2023 distributions and the December 31, 2023 value used to calculate your RMD in 2024.

This is why monthly on the 1st of the month is ill-advised. And indeed, the 1st of the month has a problem in each of my examples for the same reasons. January 1st is always a banking holiday or a weekend and its distribution date gets moved into the prior year.

Example 2: Why Not the 2nd of the Month

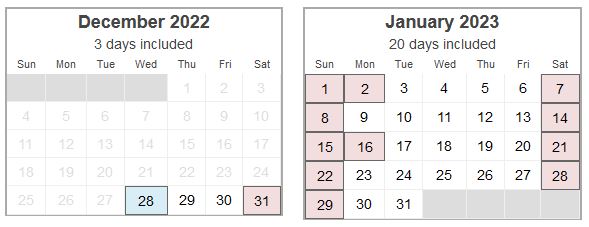

This example will demonstrate why monthly on the 2nd of the month can create a problem. For this example we will use 2023 when January 1st was a Sunday.

When the January 1st banking holiday is a Sunday, the holiday is observed on the nearest Monday, which is always January 2nd.

When January 2nd is an observed banking holiday, a withdrawal scheduled for the 2nd will be moved to the prior business day, which in this example is Friday, December 30, 2022.

This creates the same problems as the first example: your RMD is not satisfied until the literal last banking day and any mistakes are created for both prior and new RMD tax years.

Example 3: Why Not the 3rd of the Month

This example will demonstrate why monthly on the 3rd of the month can create a problem.

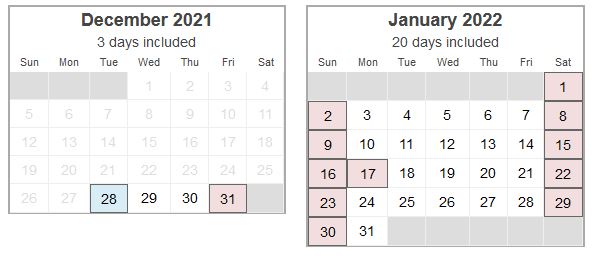

For this example we will use 2022 when January 1st was a Saturday.

When the January 1st banking holiday is a Saturday, the holiday is observed on the nearest Friday, which is always December 31 of the year prior.

Because January 3rd is a business day, a Journal from one Schwab account to another Schwab account could occur, so Schwab’s system will keep the distribution scheduled on January 3rd. However, with the distribution scheduled on January 3rd, a MoneyLink from Schwab to an external account will actually withdraw one business day prior. In this case, one business day prior to January 3rd ends up being Friday, December 30, 2021.

So while a Journal would succeed on the 3rd, a MoneyLink creates the same problems as the other examples: your RMD is not satisfied until the literal last banking day and any mistakes are created for both prior and new RMD tax years.

Example 4: Why Not the 4th of the Month

This example will demonstrate why monthly on the 4th of the month can create a problem.

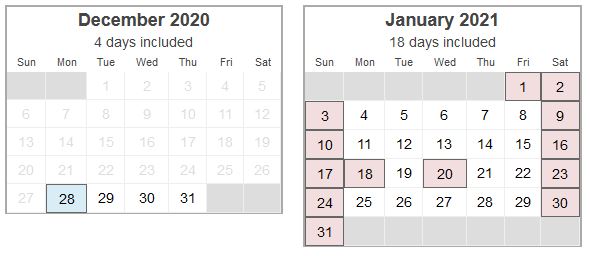

For this example we will use 2021 when January 1st was a Friday.

The trend of weekends and banking holidays interfering with RMDs continues into this example.

Because January 4th is a business day, a Journal from one Schwab account to another Schwab account could occur, so Schwab’s system will keep the distribution scheduled on January 4, 2021. However, with the distribution scheduled on January 4th, a MoneyLink from Schwab to an external account will actually withdraw one business day prior. In this case, one business day prior to January 4 ends up being Thursday, December 31, 2020.

So while a Journal would succeed on the 4th, a MoneyLink creates the same problems again: your RMD is not satisfied until the literal last banking day and any mistakes are created for both prior and new RMD tax years.

What Day Should You Distribute Your RMD Monthly

From all of this calendar math, the 5th reveals itself as the earliest possible monthly day which does not create year-end RMD problems. The reason it does not create problems is because at least two of the following are always a banking day: January 5, 4, 3, and 2. These four days can tolerate either a weekend (2 days lost) or a Jan 2nd observed holiday (1 day lost) without losing time to complete a MoneyLink.

That being said, we typically recommend that you schedule your RMDs for the 8th of each month. This is because in the worst case of example number four, the professionals who will fix problems with the scheduled RMD will first be able to see your RMD calculation on January 4. If your MoneyLink distribution is scheduled for January 5 and there is a mistake with the system, your withdrawal will distribute on January 4 before anyone can fix it.

Additionally, if there is a problem, I’d prefer to give professionals (myself included) at least two days to fix it. So January 4th to find the problem and January 5th and January 6th to work on fixing it, means that January 7th can be your MoneyLink withdrawal date for a January 8th distribution day.

Of course, some people will swing the other way and wonder if a later date would be better. On the other end of the spectrum, it is nicer to yourself when the December distribution date is earlier in the month. One must wait until that last distribution is complete before you can verify that your RMD for the year has been successfully distributed. The later in the month you schedule that last distribution for, the shorter time frame you have to fix any problems which may be found.

This is why we suggest the 8th as the ideal monthly distribution date. Early enough to help you in December, late enough to help you in January.

If you’ve read all the way through this article, I will take a gamble to suggest that you would likely love working with our financial planning team. We strive to bring this kind of expertise into all aspects of our financial planning. Feel free to reach out via our Contact form.

Additionally, if you are considering whether you’d like to distribute monthly or annually, you may find interest in our other article, “The Complete Guide to Timing Your RMD.”

Photo by Claudio Schwarz on Unsplash. Image has been cropped. Calendar screenshots from TimeAndDate.com’s workdays calculator.