Asset allocation means always having something to complain about. In 2012 that category was Natural Resource stocks which returned a meager 2.2%. US Bonds returned 4.22% and Global Bonds returned 4.32%.

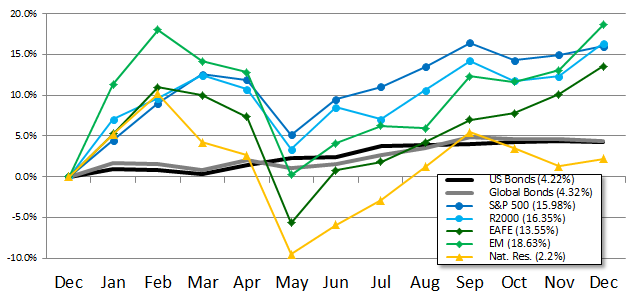

The indexes that had the best returns were Emerging Markets (18.63%), Russell 2000 Small Cap (16.35%), S&P 500 (15.98%) and MSCI EAFE Foreign Index (13.55%). Domestic markets generally performed better in the first half of the year and foreign markets in the second half of the year. Here is a chart showing how investments in these indexes performed over the year:

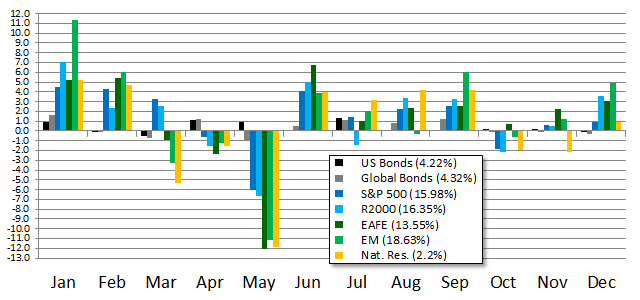

And here is the return of each index by each month:

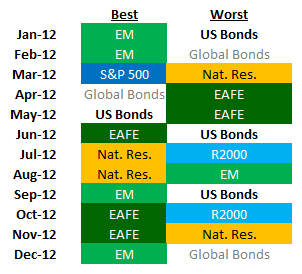

It is always interesting to see how the best and worst index each month is relatively random:

This randomness and reversion to the mean would suggest that Resource Stocks, which performed poorly in 2012, may be a good investment for 2013. During the course of 2012 the price of a barrel of crude oil dropped from $101.56 to $91.82. The Resource Stock index reported here is about 70% energy stocks.

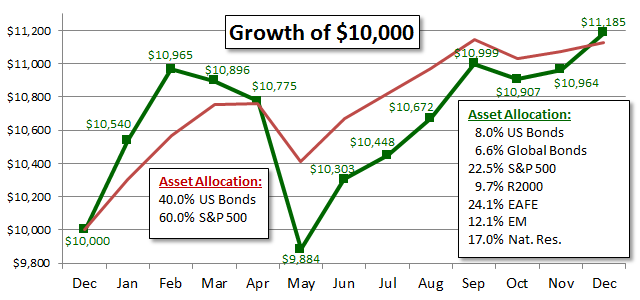

Finally, here is the growth of two different asset allocations. The returns in May of Resource Stocks, Foreign Stocks and Emerging Markets caused problems for the full asset allocation verses the typical 60-40 allocation:

Here are the codes for the indexes used along with their full description:

- US Bonds: Barclays US Aggregate Bond Index

- Global Bonds: Barclays Global Aggregate Bond Index

- S&P 500: S&P 500 Composite Total Return

- R2000: Russell 2000 Small Cap Index

- EAFE: MSCI EAFE Index

- EM: MSCI Emerging Market Index

- Nat. Res.: S&P GSSI North American Natural Resources Index

3 Responses

Peter

David,

Thank you for the informative review of the 2012.

In general, what is your opinion on leveraged ETFs?

Is there a place for leveraged ETFs for a long-term investor ? How about for a short-term investor?

Your careful review is much appreciated.

David John Marotta

Greetings Peter,

In our “Safeguarding Your Money Series“, Safeguard #4 is “Buy Investments That Trend Upward“. This may sound obvious, but this eliminates any inverse ETFs as they, on average, go down.

Leveraged ETFs which are borrowing in order to “go on margin” in order to have more invested in the markets are trying to use this to make even more money. As long as the markets are going up, you can leverage to make more money with less investment, but there is a price and the price can be increased volatility to the point of financial ruin.

Imagine that you can bet your life’s savings on a coin toss double or nothing. The best is fair, but the price (50% financial ruin) is more than you want to pay. Perhaps at the start of your coin toss you had a 99% chance of meeting your financial goals. Taking the toss you decrease your odds to only 50% even though the payout was “fair.”

Now imagine the coin toss payout is increased to quadruple or nothing. The average return is 100%! (a 50% chance of a 400% return). Even though it has an average 100% return, it still risks a 50% chance of your financial ruin when you started with a 99% chance of your financial success. Risk matters, and we think the markets are inherently risky enough.

The requirement for using a leveraged fund would be that the leverage trends upward, that a very small percentage of your assets would be put into one investments, and that you would diversify among lots of investments which are all with very low correlation to each other. Those are stiff requirements, and we think for most investors it is better *not* to use leveraging too extensively. Leveraging is additive, and most investors don’t know where too much begins.

Peter

David,

Thank you for the reply.