In Investment News’ article Actively managed funds require a steel stomach by Jason Kephart, they chronicle a study by The Vanguard Group of the 1,540 stock funds that existed in 1998 to determine what the odds were of picking a fund which beat the markets over the past 15 years.

First of all, picking a fund that’s going to be around in 15 years is tough.

Of those 1,540 actively managed stock funds that investors could’ve picked in 1998, only 894, or 54%, still existed at the end of 2012.

Picking one that’s going to outperform is even tougher.

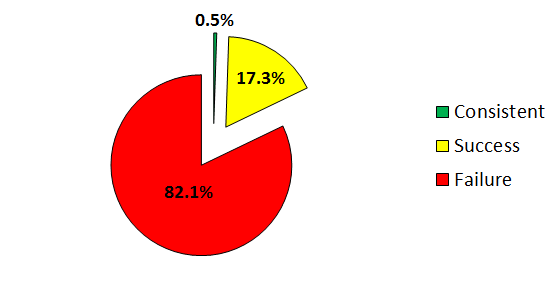

Only 275 of the mutual funds that existed in 1998, or 18%, have produced returns greater than their respective benchmarks over the 15-year period ended in 2012, according to a Vanguard study released last week.

Translated, that means that actively managed funds have had an 82% failure rate.

And even the 275 “winners” did not do so consistently:

Almost all of the funds that beat their benchmarks over the 15-year period did so with some missteps along the way. All but eight of the 275 funds that outperformed suffered at least five calendar years of underperformance over the period and 181, or 65%, suffered at least three consecutive calendar years of underperformance.

Investors are usually not willing to allow a fund to have 5 of 15 years underperforming. And yet all but 0.5% of funds underperform at least 5 of the years.

And because investors chase returns rather than staying the course, they even underperform the very funds they are invested in!

Those bouts of underperformance are clearly hard for the average investor to swallow. That’s why investor returns, which Morningstar Inc. calculates using mutual fund performance combined with data on investors’ purchase and sale of fund shares, almost always trail outperforming funds’ actual performance over long time periods.

The $16.3 billion Vanguard Windsor Fund (VWNDX), for example, has an annualized return of 7.24% over the 15-year period ended Oct. 31, which tops the S&P 500 by 2.14 percentage points. But the fund underperformed in 2007, 2008, 2010 and 2011 before rebounding in 2012 to beat the index by four percentage points that year, and has continued that streak year-to-date through Oct. 31, according to Morningstar.

The Windsor Fund’s shareholders lost a percentage point of return a year over the last 15 years, though, thanks to not staying the course, or selling when it was down and only buying when it was up.

One of the disciplines necessary to receive a rebalancing bonus is the ability to periodically rebalance your portfolio, taking money out of what has done well and putting it into what has not done as well.

Managing investment assets requires managing investor expectations.