We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

A Good Time to Have a Balanced Portfolio

We have a saying around here: It is always a good time to have a balanced portfolio.

Two Financial Planning Strategies For Business Owners

At the end of the year, you want to have something to show for all of your hard work.

#TBT Can I Contribute to Both a SEP and a 401(k)?

The IRS very clearly says, “Yes, you can set up a SEP for your self-employed business even if you participate in your employer’s retirement plan at a second job.”

Does the Date of My Birth Affect My Contribution Limit?

Thankfully, the IRS does not care what specific day you were born on, only which year.

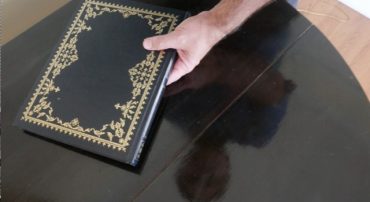

#TBT My Grandfather’s Journal: Don’t Be Afraid to Try

I have enjoyed rereading the journal of my maternal grandfather, Donald Mortlock. He started writing it on his 75th birthday.

Did My Lump Sum Rollover Mess Up My Backdoor Roth?

Depending on how you initiated the lump sum rollover, you may be in luck.

#TBT Your Asset Allocation Should Be Priceless

Rebalancing from stocks into bonds reduces your returns on average since bonds have a lower average return. But, as this 2015 article reminds us, there are decades of very choppy markets where even rebalancing an allocation of stocks and bonds can boost returns.

How to Budget for Emergencies

It is possible to be prepared for financial emergencies by living 10% more frugally and saving for the inevitable eventuality.

#TBT Fund Your HSA To Cover Retirement Healthcare Costs

This 2007 post offers us a bit of timeless advice. Funding a Health Savings Account can be as much about your present medical bills as it is about your end of life care.

Professionals Agree: Having a Fee-Only Advisor Matters

We write frequently about the value of having a fee-only fiduciary as your financial planner. In this article, I compiled others’ voices on this same issue.

#TBT How to Calculate Your Own Safe Spending Rate

Questions regarding spending are often best solved by determining the safe withdrawal rate.

How to Find the Fidelity Secure Message Center

Even Fidelity says that their Secure Message Center is hidden and they should have a tutorial to find it.

#TBT The History of Mutual Funds

93 years ago there was only one mutual fund. Today, there are thousands. This 2003 article tells the story of how this staple of the financial services world got its start.

The Right Day to Distribute Your RMD Monthly

If you want to take our word for it, you can schedule your monthly RMD for the 8th. If you are curious as to the calendar math that suggests this date, read on.

#TBT It is Time to “Scrap the Tax Code”

Our first article posted online is a wonder to behold. This 1998 beauty is written by George Marotta, founder of Marotta Money Management. In the article, he reminds us that, “Anyone of us could design a better system, but 500 congress people cannot resist the pressure groups who want to twist the code to benefit their particular constituencies.” Decades old, this post still rings true today.