We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

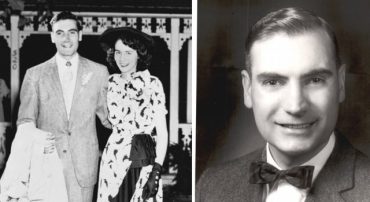

Founder’s Day: Celebrating George Marotta (Part 3)

My grandfather turns 97 this year. While not often celebrated or recorded in history, my grandfather played an important supporting role to many important events.

#TBT Can I Use 529 Funds for Off-Campus Housing?

Yes, but housing is one of many expenses that are subject to a reimbursement limit. Here’s how to do it.

Distribute Your First 401(k) RMD in April or December?

Within employer-sponsored retirement plans, there are special provisions for employees (not owners) who continue to work beyond their typical required beginning date.

529-to-Roth Rollover Contribution Available in 2024 (Secure 2.0)

This new rule says that the account owner can distribute funds from a 529 plan directly to the designated beneficiary’s Roth IRA and have the rollover “be treated in the same manner as the earnings and contributions of a Roth IRA” (meaning no taxation).

Avoid Investing Mistakes (the series)

This series of articles covers some of the most common investing mistakes and how to avoid them.

All About Greg Vairo, CFP®

We are very pleased to announce that Greg Vairo is our newest CERTIFIED FINANCIAL PLANNER™ (CFP®) professional at Marotta Wealth Management!

We Are Not Afraid. (A Reply to Recent Headlines)

There are strategies to achieve a better inner calm.

How to Upload a Secure Document to Marotta

We can receive documents to our secure ShareFile client portal.

Proposed RMD Rules: The Madness Continues

“And the now-20-year-old beneficiary who lost her father less than a year ago is supposed to navigate this mess on her own? No chance. This is madness.”

QCD Limitation Starts Inflation-Adjusting in 2024 (Secure 2.0)

Congress decided to inflation-adjust both the existing and the new split-entity qualified charitable distribution limitations.

#TBT Which Products Do You Buy and Which Do You Avoid?

We avoid investments we deem too risky or laden with fees and seek instead a well balanced, low-cost, diversified portfolio.

What is a Charitable Remainder Trust?

It is helpful to know that a charitable remainder trust exists, but most charitable intentions benefit more from a donor advised fund.

How to Avoid a Cashier’s Check Scam at Schwab

The Schwab Bank representative said that he was familiar with these types of scams and knew how to handle it.

#TBT The Optimum Asset Allocation to Gold Is Always Zero

Fearful of monetary or societal failure, many hope that owning gold will bring them peace of mind. This articles reminds us to get peace of mind a different way.

Fee-Only Is the Most Important Quality in Your Financial Planner

The reason can be explained through a simple analogy about an interior decorator.