We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Healthy And Wealthy Adds A Decade To Your Life Expectancy

The national average life expectancy is not a good measure for our clients’ life expectancy. That means planning beyond ages 82 and 85.

Financial Christmas Gift Ideas

Financial Christmas gifts don’t need to be a piggy bank. They can be more serious and more meaningful than that.

Ameriprise Sued By Ameriprise Employees Over Excessive 401(k) Fees

A fundamental fiduciary principle is to avoid self-dealing.

Social Security Loopholes Scheduled to Sunset

The Bipartisan Budget Act of 2015 ends two very profitable Social Security optimization techniques that allowed some savvy beneficiaries to take up to $50,000.00 in additional lifetime income.

An Immediate Annuity Is Probably Never The Right Answer

The Journal of Financial Planning featured a nice column by Harold Evensky entitled “These Innovative Research Papers Deserve Your Attention.”

Utilizing Uncommon Beneficiary Designations

Will substitutes sacrifice some of the customization of trusts but avoid the accounting complexities.

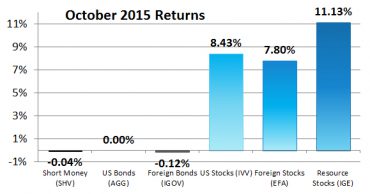

October 2015 and Year-to-Date Returns for Our 6 Asset Classes

October showed a sharp reversal of the movements of Resource Stocks.

Radio: The Broken Promises of the Government

David Marotta was interviewed recently on radio 1070 WINA’s Schilling Show discussing some of the government’s broken promises

The Hunger Games: Mockingjay, Part 2

I encourage you to read the books and watch the film.

Understanding Your IRA Required Minimum Distributions (RMDs)

After you reach the age of 70 1/2, the IRS requires you to begin taking minimum distributions from your traditional retirement accounts.

When Are Taxes Due On A Roth Conversion?

Any tax which is ultimately going to be owed is owed by April 15th. Otherwise it may be subject to interest and penalties.

Mailbag: When Can I Move Into a 1031 Property?

Because 1031 exchanges are a great way to defer paying large amounts of capital gains tax, the IRS tends to be suspicious of them.

Baby Bear: The Bear Market of 1966

Examining past Bear Markets can help provide some context when we experience the next one.

Safe Withdrawal Rate Adjustments

Assumptions about these adjustments to your net worth should be made carefully and conservatively.

What Capital Gains Is Owed For The Sale Of Gifted Stock?

It is better to leave stock to a family member in your estate plan than to gift them the stock while you are alive.