We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

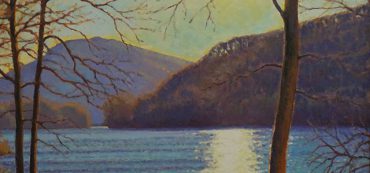

Artist Interview with Malcolm Hughes

Marotta Wealth Management is showing original oil paintings by Malcolm Hughes at our office this fall!

Donald Trump’s Tax Plan

Tax season under Trump’s plan would likely be just as complicated but slightly less painful.

How Much Can I Contribute To A Roth IRA If I Earn Too Much?

I’m on the borderline for being able to contribute to a Roth IRA. How do I determine how much I can contribute?

How To Correct Excess Roth IRA Contributions

Regardless of the reason, if you have put too much money in your Roth IRA, the solution is the same.

Can I Contribute To My Wife’s Roth IRA?

I have earned income but my wife does not. Can I contribute to my wife’s Roth IRA?

U.S. Growth Stocks Stand Their Ground in 2015

This year, almost every U.S. asset class is in the red except for growth stocks. When the market is throwing punches, you need a tactical defense.

How to Help Clients Cope With Scary Markets

Staying the course when an index investment is down is very uncomfortable in the short-term but usually the best course of action in the long run.

What is a Backdoor Roth?

Even over the income threshold, you may still be able to add funds to your Roth IRA with what is called a backdoor Roth.

Mailbag: Roth IRA vs. Roth 401(k), Which is Better?

Differing legislation makes one of the two preferable.

Mailbag: Can I Use My IRA As Collateral?

There is a complex way, but we don’t recommend the strategy.

Advisors Save Clients From Costly Mistakes By Social Security Workers

Those costly mistakes are a fifth of a million dollars in most cases.

When Should You Stop Funding Your HSA?

You’ve opened your HSA and funded it for several years. When should you stop funding it?

Radio Interview: How Volatile Are the Markets?

David John Marotta was interviewed on radio 1070 WINA’s Schilling Show discussing market volatility.

Medicare High-Income Premium Surcharges – 2015

These premium surcharges are typically unavoidable except for some planning a Roth Conversion.

Five Good Reasons to Hire a Financial Advisor and Two Bad Ones

The job of a financial advisor is to do what you would do if you had the time and expertise.