We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

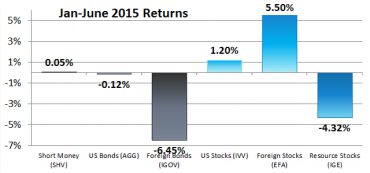

Second Quarter and Year-to-Date Returns for Our 6 Asset Classes

Despite the headlines, the global equity markets posted gains last quarter and for the year.

The Behavior Gap: Finding Your Financial Balance

Planning for your financial future is largely a question of dealing with the constant tension between living for today and saving for some future event.

How to Take Advantage of Student Loan Forgiveness

You might think that you can’t qualify, but many well-paid families are eligible.

How to Get Out of Debt: Summary

This is a visual summary of the process of getting out of debt.

Managerial Lessons from Game Mastering

Pen-and-paper roleplaying games have a lot of unique lessons to offer, particularly for policymakers and managers.

Mailbag: What Does The Shanghai Composite Being Down 32.1% Mean?

Is it a crash or just a correction? On average, the drop from peak to trough takes 85 days and the markets have recovered after another 107 days.

How Quickly Should I Pay My Student Loans?

For those who do not want to be investors, a fast-track repayment may be best. But for those willing to save and invest, there is a better option.

What Should I Do When They Close The New York Stock Exchange?

Is there something I need to do today or tomorrow?

Investment Stewardship Has Come a Long Way

Advisors have helped to shift fund management toward stewardship, but many fund companies still have room for improvement.

Only 20% of Advisors Avoid Active Management Strategies

The majority of advisors make the mistake of having significant or moderate use of actively managed funds.

How to Intentionally Realize Capital Gains

Careful tax planning can avoid much of the capital gains tax.

How to Get Out of Debt: Rebuild

You have laid a good foundation: you are out of debt (or out of bad debt) and you’re ready for a clean start. Commit to keeping your financial life that way.

Why is Organic Food Expensive?

Organic food has a reputation for being healthier than non-organic food, but neither of these claims should be taken at face value.

The Markets Are Inherently Volatile

Most investors don’t understand what that means.

The Complete Guide to Automating Your Savings

After automating your entire investment plan, you can save and invest without even having to watch.