We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

The Mystery Of The Invisible Hand

Read an excerpt from Ken Elzinga’s latest Henry Spearman mystery novel.

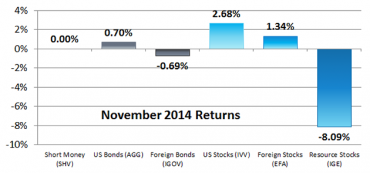

November 2014 Returns for Our 6 Asset Classes

Here are the returns for our six Asset Classes from November 2014.

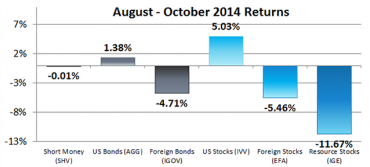

August – October 2014 Returns for Our 6 Asset Classes

Here are the returns for our six Asset Classes from August 2014 – October 2014.

Stop Borrowing From Yourself

Stop borrowing from your future self. Each day you fail to save is another day where you tighten the ball and chain around your ankle. You deserve better than that.

Radio: Charlottesville Real Estate

David John Marotta appeared on the radio discussing Charlottesville real estate, interest rates, and how you should not let a daunting pile of mortgage paperwork stop you from purchasing a home.

How To Buy A College Degree

Unfortunately, Obama’s good intentions are thwarted by the economic principle formulated by banker Charles Goodhart.

Cheating Isn’t Just For Students

Increased pressure will only force more teachers to choose between their integrity and their salaries.

Financial Willpower

The amount of energy available in the brain to exercise self-regulation and resist temptation is a limited resource. When the account runs out, well… you know the kind of decisions you make.

What Investors Really Want

“In reflecting on our experiences as advisers and investors, we’ve come up with what we believe are the key and often unspoken wants and needs of our investors.”

The Economics of a Thanksgiving Turkey

The average factory-farmed frozen turkey from a grocery story is sold for as little as $0.67 per pound. Economics can offer five explanations.

2015 IRA and Roth Contribution Limits

Here are the 2015 contribution limits and income phaseouts for contributions to Traditional IRAs and Roth IRAs for retirement saving planning.

Five Principles Of Spending

How to judge if your money was well spent.

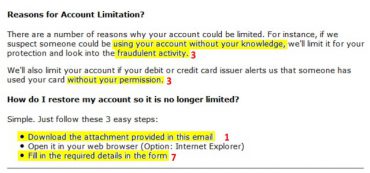

Ten Red Flags Of Emails Trying To Steal Your Identity

Eternal vigilance is the price of liberty.

We Need a Partial Shutdown of Government

Unless McConnell is willing to risk a government shutdown, he will ultimately have to acquiesce to Obama’s wishes.

Radio: Parts of the Government Should be Shut Down

David John Marotta was interviewed discussing government waste and what would happen if parts of the government were shut down.