We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

FINRA Supports Regulation to Quell Competition

Beware of government regulation, especially when a portion of the industry thinks it’ll be good for business.

Study on Investment Advisers and Broker-Dealers

These are the wolves of Wall Street pretending to be the helpful sheep of investment advisors.

The Benefits of Saving and Investing Early

Any money you put away and invest now will have the longest time to grow, due to the magic (or actually, the mathematics) of compound interest.

SEC Q&A: What Is the Difference Between an Investment Adviser and a Financial Planner?

This is why we call ourselves comprehensive wealth managers.

Mailbag: Can I Roll My IRA Into A REIT Tax-Free?

A reader asks, “My wife has a $250K SEP IRA earning 1.5% interest. Can we use any of the funds for real-estate investments?”

Taxes on Non-Deductible IRA Contributions

“Once you put cream in the coffee, all coffee removed from the cup is partly cream and partly coffee.”

How To Designate Charitable Gifts In Your Schwab Donor Advised Account

Schwab Charitable Donor Advised Funds make the gifting process easier.

Fight the NSA with Your Choice of Search Engine and Browser

We are all embarrassingly honest with search engines.

The Politics of Social Security

Even half of what they collect in Social Security could provide a better private benefit.

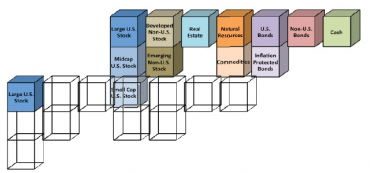

Does Every Client Get Put Into One Of A Few Investment Allocations?

The short answer is, “No.”

Capability Is Tyranny

Those who stand by and do nothing are complicit in aiding the loss of freedoms for others.

Seven Quotes to Summarize U.S. Surveillance

“We don’t have concentration camps and political dissidents and large numbers being hauled into prison because we don’t need that because we have effectively put prisons inside people’s minds.”

What Benchmark Should I Measure My Return Against?

Don’t let the noise of random returns ruin a brilliant investment strategy.

Advisers Worry About Potential Costs Of Third-Party Exams

“Estimates range from $5,000 to $20,000; sharp opposition to Finra getting involved.”

Fourteen Ways to Avoid Paying Capital Gains

The capital gains tax traps wealth in an investment vehicle requiring special techniques to free the capital without penalty.