We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Five Red Flags You Picked The Wrong Financial Advisor

Five red flags any one of which should make you stop and reconsider.

Shareholder Elections: Why Vote?

Does it really matter if you cast your votes in shareholder elections? Probably not if you are a small investor. But if so few are participating, can we blame corporations for forgetting whom they serve?

Five Easy Ways To Save

This kitten is frugal. Be more like this kitten.

Financial Advice for Recent College Graduates

Financial advice for college graduates is easy. Graduates street smart enough to take the advice is rare.

Do Tariffs Protect an Infant Industry?

Do infant industries need tariffs to protect them from their own inefficiency and stupidity?

Preparing to Retire – Wealth Management Carnival #12

Today’s carnival is all about retirement: saving for it, where to open accounts, how much to withdraw once you do retire, and more. Read on for more details!

Essential Financial Advice for College Graduates

As the wife of a 2013 college graduate and a 2012 college graduate myself, I can boldly say this was the most helpful advice given to me.

How to Find a Financial Advisor, Step by Step (PBS Newshour)

You’re looking for an enduring relationship based on mutual respect and trust, so plan on investing at least as much effort as you’d put into choosing an automobile, especially a used one.

Shareholder Meeting: Why Go?

My first experience with these shareholder meetings was a major turnoff. In March 2009, I purchased a limited number of shares of Genworth (GNW) stock for reasons I do not proudly share among value investors.

The Dangers of Automated Payments

This kitten knows how much she spends. Be more like this kitten.

Gold, Silver and Resource Stocks

The optimum asset allocation to physical gold and silver is 0%. Instead, we recommend you use resource stocks as an inflation hedge.

Is There A Moral Case for “Buy American”?

Perhaps we would be economically better off with global trade, but do we have an obligation to maintain a higher moral standard?

Video: What’s So Great About Economic Freedom?

Is economic freedom related to other kinds of freedoms? Does economic freedom affect personal choice?

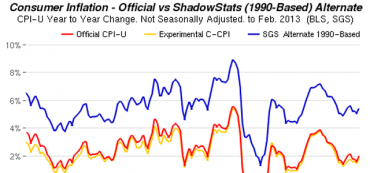

CPI Inflation Rate Calculator (Experienced vs. Reported)

Have you ever wondered why the CPI, GDP and employment numbers run counter to your personal and business experiences? The problem lies in biased and often-manipulated government reporting.

Limit Your Investment In Gold and Silver To Less Than 3% of your Portfolio

“Why Buffett thinks investing in gold is stupid”