We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Threats to a Fulfilling Retirement

“Inflation and loss of capital pose dangers to retirees seeking a sustainable income stream.”

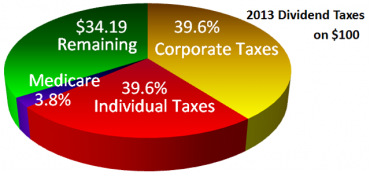

Tax on Dividend-Paying Stocks Rising to 74%

With the enormous increase in the taxation of dividends, high net worth investors may be tempted to abandon dividend-paying stocks entirely. This is not necessary.

Success and Significance in Retirement

Most Americans fail to plan adequately for retirement. As a result, they often miss out on opportunities to enjoy the second half of life.

The Wisdom of Jack Bogle: Part 2

Faster is not always better. So says an energetic 83-year-old Jack Bogle, the Vanguard Group founder who has spent most of his career striving to protect the individual investor.

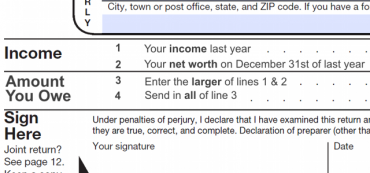

Financially Savvy Kittens on Net Worth

This kitten knows what she’s worth. Be more like this kitten.

How to Avoid the Vehicle Sales Tax in Virginia

“I would like to give my daughter my newer car, but the tax considerations are not simple.”

Capital Gains Tax is an Economic Monkey Wrench (2012)

Tax on capital gains is scheduled to rise and become much more complex at the end of this year. Keeping your head in the midst of these changes can help your bottom line. Government should tax either the value of an asset or its yield but not both.

Last Chance for a Roth Conversion during 2012

While Roth conversions will be advantageous for some next year, they are advantageous for nearly everyone in 2012.

Old Abe’s Thanksgiving Proclamation

I do, therefore, invite my fellow-citizens in every part of the United States, and also those who are at sea and those who are sojourning in foreign lands, to set apart and observe the last Thursday of November next as a Day of Thanksgiving.

Financially Savvy Kittens on Smart Shopping

This kitten delays major purchases. Be more like this kitten.

Radio Interview: How to Cope with Post-Election Depression Syndrome

“I was talking to a doctor in town who said he was surprised how many patients he had seen with clinical depression over the election results. I believe the definition of clinical is the thought that ‘Things will never be good again.'”

Seven Tax-Planning Strategies to Dodge the Tax Bullet

The victors in the recent election have declared it open hunting season on the rich, which they evidently believe will solve our spending problems. Tax hikes everywhere are aimed at the most productive members of society.

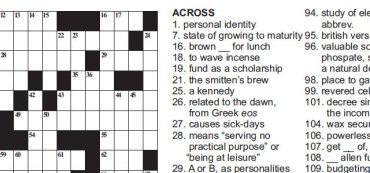

Free Printable Online Crossword Puzzle

Want to try your hands at our latest advertising campaign. Print your own copy of our crossword!

Jack Bogle: The Father of Passive Funds Gets Active

I found it very interesting that Bogle directs much of his criticism at the mutual fund industry and even Vanguard itself. Bogle argues that fund companies should be doing a better job challenging the excesses of executives and corporate managers.

Financially Savvy Kittens on the Definition of Success

This kitten measures success from the bottom not the top. Be more like this kitten.