We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

$ ?s: Maintaining Health Insurance After Losing Your Job

Review your health insurance options after losing your job – COBRA and High Deductible Health Plans.

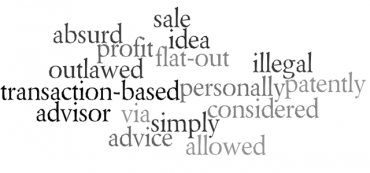

It’s Flat-Out Illegal in Other Countries

There is great disagreement in the financial services world if an advisor who has continuous and comprehensive management of a client’s assets should be allowed to also benefit from transactions that they recommend.

How Much Should I Save for Retirement?

You should save 15% of your take-home pay for retirement over your working career. As your situation varies, you must adjust your safe savings rate.

Seven Interesting Investment Ideas — Wealth Management Carnival #1

In the Wealth Management Carnival, we share 7 Interesting Articles from other sources. From advice to diversify investments to index fund criteria to choosing a bank, this month we found seven articles that discussed various investing ideas.

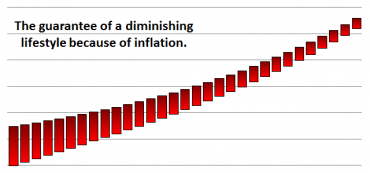

How Keeping Your Money “Safe” Might Lose Half of It in 16 Years

“Anyone who’s bought gas, paid a medical bill or sent a child off to college recently knows that the Consumer Price Index doesn’t tell the whole story of inflation.”

$ ?s: Buy a House without a Credit History?

Although it is possible, buying a house without a credit history will require you to jump through some uncommon hoops to find a competitive rate.

How Do I Find a Fee-Only Commission-Free (Hourly Rate) Financial Advisor?

Many people prefer having a local fee-only commission-free financial planner they can easily visit on a regular basis. Others prefer to handle everything through phone and email.

The False Promises of Annuities and Annuity Calculators

The entire selling point of the immediate fixed annuity is a lower return in exchange for a guarantee. But when analyzed, the purchase price is a loss from which you can never recover.

Radio: Paul Ryanomics

David Marotta appeared recently on radio 1070 WINA’s Schilling Show discussing Mitt Romney’s Vice Presidential pick of Paul Ryan, and what Ryan’s economics really look like.

How the Wealth Management Carnival Works

A Blog Carnival is like a magazine. It has a title, a topic, editors, contributors, and an audience. Editions of the carnival come out periodically (usually twice monthly).

Blame the Joint Committee on Taxation not the CBO

It would have been more accurate to say, “The Joint committee on Taxation by agreement with congress is required to limit their analysis to a fixed GDP assumption.”

$ ?s: Can Social Security Checks Be Mailed To Foreign Soil?

It is estimated that as many as 40,000 American citizens reside in Costa Rica, and many are retirees who are stretching the purchasing power of their Social Security paychecks.

Why Are People Who Have Built a Business Leaving Their United States Citizenship?

If eight times as many people are leaving the country than they were 4 years ago, maybe there’s something wrong with the country?

Get Connected to Kittenomics

Like our financially savvy kittens? They like you too! You should meet all the kittens.

You Need Life Planning

Quote from David John Marotta on why you need life planning.