We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

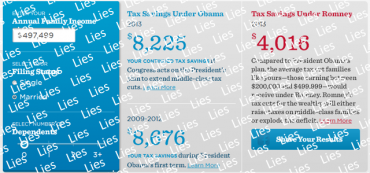

Obama Lie-O-Matic Tax Calculator

There’s a term in the financial world for Internet sites like these and that term is “fraud.”

Earn More Money! A Simple Way Toward Building Wealth

More advisors are coaching clients on how to earn more income.

$ ?s: 72(t) and Other Early Retirement Distribution Options

There is a separate set of rules for those under age 55 or who are looking to distribute from an IRA. These rules focus on an exception called Substantially Equal Periodic Payments (SEPPs).

Valuable Property

“Real estate investment trusts should be much more than an optional selection in a balanced investment portfolio.”

Smart Tax Planning for the Gap Years

Many families seek financial planning advice specifically for retirement. But if they wait too long, they miss an important tax-planning opportunity. A great strategy is to take advantage of the time between retirement and Social Security at age 70, the so-called gap years.

Muni Forecast: Lots of Clouds

“A growing link between municipal bond and U.S. stock performance could be very bad if equities fail to rise robustly over the next few years.”

Stable Value Funds Serve Investors But Scare Plan Sponsors

During the 2007 – 2009 financial crisis, many stable value funds were on the brink of disaster due to risks that were unknown to the average investor.

Mailbag: How Can I Get Started Gifting Appreciated Investments?

Do I start planting investments and then refrain from giving for ten years?

Ignore the Politicians and Take Control of Your Financial Freedom

During elections the political dialogue assumes that the well-being of your future is out of your control and in the hands of politicians. This is simply not true. You have the freedom to take control of your finances and your life.

Investing In Gold

Direct ownership of gold has become more popular, despite some lingering fear that the government could again ban private gold ownership. With ongoing concerns about the global financial system and gold hitting a record high, many people are interested in this “safe haven.”

College 529 Savings Plan Distribution Rules ($ ?s)

Q: We have saved money for our grandchildren’s college expenses with 529 plans, and now the first is set to begin. What advice do you have as we begin to make distributions from these accounts?

Doctors Need Financial Planning Help, Too…

How is the ‘financial health’ of most physicians? Most physicians put in long hours and due to lack of time neglect their own financial and retirement planning.

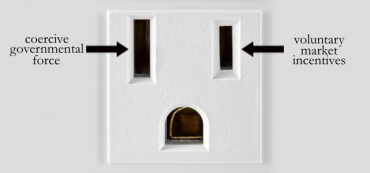

What Kind of Power Is the Most Dangerous?

Americans continue to talk past each other by using a similar vocabulary while really discussing very different concepts. Views also differ on the concept of power.

Radio: What Power is the Most Dangerous?

David John Marotta appeared recently on 1070 WINA’s Schilling Show discussing power–particularly government power–and what kind is the most dangerous.

Why Investors Don’t Rebalance

“Perfectly rational individuals exhibit changing risk aversion that makes it hard for them to rebalance into high-return assets that have had steep price declines.”