We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Consider Refinancing With A No-Closing-Cost Loan

Out-of-pocket closing costs are a big deterrent to would-be refinancers. Is it better to stay with the higher rate or get the lower rate and pay the closing costs?

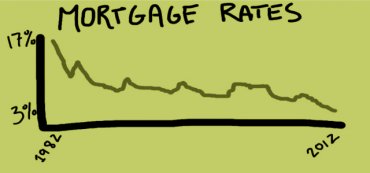

Our Grandparents Would Say ‘Duh!’

“In this [new investment reality] environment, near-term inflation is not likely to be much of a concern. The challenge will be to adapt to possible lower total portfolio returns. “

Fund a Teenager’s Million-Dollar Retirement

We teach teenagers a lot more about sexuality than we do about money. This can confuse them about what they should be learning. Give this article to a teenager and encourage him or her to start a Roth IRA.

When is Enough Regulation Enough for Regulators?

Apparently, Never. The Dodd-Frank bill can be likened to giving the government unlimited powers and asking them to eliminate evil.

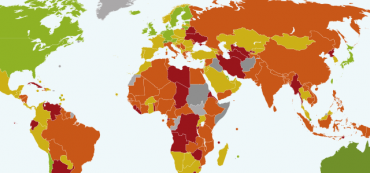

Freedom Investing Worth 4.3% Over the Last Twelve Months

Countries are constantly in flux, and with all the noise of the markets, it is easy for the noise drown out the signal.

Four Reasons Convertible Bonds Are Flawed

Generally speaking, financial complexity is a curtain behind which the finance industry can extract its fee. When the curtain is pulled back, convertible bonds fail to add value for four specific reasons.

Is Federal Student Aid Among the Best or Worst Government Programs?

The unintended consequences of good intentions can do more economic harm than all the mean-spirited greed within capitalism.

Squirrel Away Money While You Can

Franco Modigliani won the Nobel Prize for a simple technique that squirrels know intuitively from birth. You have to squirrel away some nuts during times of plenty so you can survive during times of scarcity.

Radio: What Equality Should We Seek in Society?

David John Marotta was interviewed on radio 1070 WINA’s Schilling Show discussing the idea of “equality” in society.

Why Do Women Earn Lower Incomes Than Men?

Choosing to work less than 80 hours is not wrong, especially not when all you are going to get is that last 30%.

Hedge Funds Trail Vanguard Index Funds

In another edition of “you can make the numbers say whatever you want” two financial industry studies are contradicting each other.

A Grown-Up Discussion on Income and Wealth Inequality in America

Most work toward equality of results impoverishes everyone.

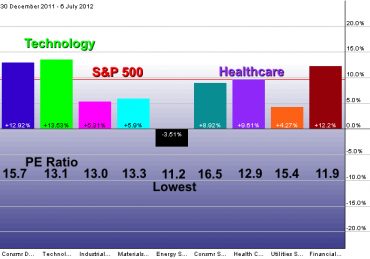

Technology Sector Doing the Best YTD, Energy the Worst

Sector rotation would suggest that we are still at the beginning of a market recovery. This is probably the bottom of energy stocks.

What Equality Should We Seek in Society?

Studies suggest that brains may be wired with either a utopian or a tragic view of the world, corresponding roughly to liberals and conservatives. We continue to talk past each other in political debates.

Even with Low Interest Rates You Should Have an Allocation to Bonds

“Investors may hold fixed income securities to reduce portfolio volatility, generate income, maintain liquidity, pursue higher returns, or meet a future funding obligation.”