We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

How Do Financial Advisors Earn Their Fee?

Investment fees are generally about 1% of assets under management and drop as assets rise. The critical question to ask is “Where do financial advisors add value that might exceed the 1% fee they charge?”

Brotherly Agape World is $415M Ponzi Scheme

Most consumers do not know how to safeguard their money. Here is a real world example of why breaking any of the eight safeguard puts your money at peril. Make sure that your investments are properly safeguarded.

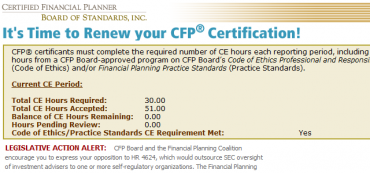

I Just Renewed My CFP Designation. They Oppose FINRA Oversight of CFP Advisors.

The rules which would begin to be applied to the watchdogs would not be for the sake of protecting the roost no matter how much the foxes suggest they do.

Social Security Time Machine Opens Door for Retroactive Benefits

There are several options to claim retroactive Social Security benefits. Some retirees will find it beneficial to turn back the clock in order to receive large one-time checks when they first file.

Five Questions To Ask A Potential Financial Advisor

“You’ll want to interview several potential candidates, and make sure you find the right person for the job. Use these questions to hire the right financial advisor.”

What is an Accredited Investment Fiduciary?

Fi360 promotes a culture of fiduciary responsibility and improves the decision making processes of investment fiduciaries and other financial service providers.

Fee-Only Financial Planner: What’s the Difference?

Fee-only financial planners are registered investment advisors with a fiduciary responsibility to act in their clients’ best interest. They do not accept any fees or compensation based on product sales.

Video: How to Find a Financial Advisor by SmartMoney.com

Experts Explain: Finding a Financial Advisor. How to find the right person to help manage your money.

Radio: Tax Planning in 2012

David John Marotta was interviewed on radio 1070 WINA’s Schilling Show discussing tax planning in 2012 and the most important things to do now to prepare for rising taxes in 2013.

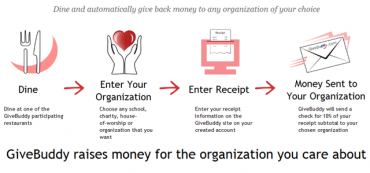

GiveBuddy.com – Dine and Raise Money for the Organization You Care About

Last month I was eating lunch at a local restaurant when I noticed an offer by GiveBuddy.com that the restaurant would send a check for 10% of my receipt to any organization I chose.

Three Questions to Ask Before Establishing a New Company Retirement Plan

Here are three questions that every small business owner should answer before establishing a new retirement plan.

David John Marotta an Article Competition Finalist

David John Marotta’s article “Ten Questions to Ask a Financial Advisor” was a finalist in the fi360 2012 Article Competition.

Mystery Novels Featuring Money Manager Anderson Crown by Donald Jay Korn

Interview with Donald Jay Korn, author of mystery novels “Payable On Death” and “In For a Pounding” featuring money manager Anderson Crown.

Emerging Market Bond Funds

Emerging market bonds are an attractive way to get a higher yield, but historically they have come with higher volatility and a high incidence of default. But that has been changing.

Radio: Ten Best ETFs of 2012

David John Marotta was interview on radio 1070 WINA’s Schilling Show discussing why you shouldn’t hold gold or cash, how governments can destabalize economies, and what investments you should hold instead.