We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

$ ?s: Dividend Portfolios Carry Hidden Risks (Part 2)

Q: Do you recommend dividend-paying stocks? If not, what investment strategy do you recommend for retirees like me who are seeking income from our portfolios?

Rebalancing Asset Classes and Subcategories

Diversifying your portfolio means finding assets that have value on their own merits but do not move exactly alike. Here are the principles on building and rebalancing asset classes and subcategories.

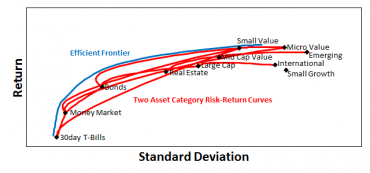

Asset Allocation and the Efficient Frontier

Crafting portfolio asset allocations is a combination of art and engineering. Just as a blending of colors can produce cerulean, so a blending of indexes produces a unique shade of risk and return.

Subscribe and receive the free presentation: The Ten Best ETFs of 2012

David John Marotta presents a list of the best Exchange Traded Funds (ETFs) of 2012 and how you can take advantage of these funds in your investment portfolio.

Subscribe and stay current on the latest wealth management advice!

After subscribing you will receive free premium access to several video presentations.

Subscribe and receive the free presentation: 10 Money Ideas for Retirement

David John Marotta presents ten important wealth management ideas for those in and approaching retirement.

Subscribe so you won’t miss a single Wealth Management Carnival!

Subscribe so you won’t miss a single Wealth Management Carnival!

Subscribe and receive free presentation: Last Chance for a Massive Roth Conversion

David John Marotta presents how to use Roth conversions, segregations and recharacterizations to put the most money where it will never be taxed again in the most tax efficient manner.

Mailbag: Should I Pay Off My Mortgage Early?

Some say don’t make extra payments, take the tax deduction. Others say you need to be debt free.

$ ?s: Dividend Portfolios Carry Hidden Risks (Part 1)

Dividend investors are too easily lulled into the temporary comforts of portfolio income.

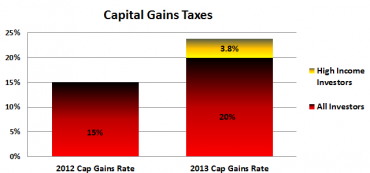

Capital Gains Tax Rising

Starting in 2013, pending further legislation, the capital gains tax will go up to 20%.

George Marotta Featured in Reuters Article by Linda Stern

The 85-year-old Palo Alto patriarch has turned helping his 10 grandchildren into a hobby that has paid off for multiple generations.

The Efficient Frontier

The efficient frontier measures all investments on a scale of risk and return. Risk is commonly placed on the x-axis, and return is placed on the y-axis.

Mailbag: How Should I Invest a Roth IRA that My Children Will Inherit?

Should it be invested aggressively, like 100% equities, or use the same split as my taxable investments, such as 50-50 stocks vs bonds?

Buffett is Winning $1M Wager with Hedge Funds

Buffett estimates that he has a 60% chance of winning. This is in line with statistics suggesting that low cost funds beat high cost funds more than half the time.