We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Is Money Pulling You Apart?

Financial troubles and marital troubles go together. Does financial largess therefore also go with marital harmony? Do something romantic together: Engage a fee-only financial planner.

Radio: How To Get Thousands More Out Of Social Security

David John Marotta and Matthew Illian discuss how to get more from Social Security by filing at the right time and taking benefits at the right time.

Before You Say “I Do”: Money & Marriage Exercise 1

Couples that fail to prepare for a shared money maturity will likely experience longer and sharper growing pains.

Wealth, Not Cash, Spreads Prosperity

“Unlike the government economic advisor, these entrepreneurial castaways are not making, i.e. printing, money. Instead, they’re creating new wealth by producing things that others find valuable.”

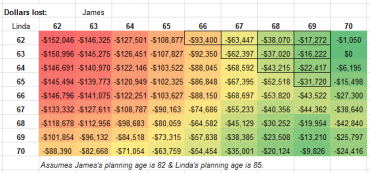

Gain $152,000 by Smart Filing for Social Security

Social Security benefits can represent a big stack of cash. A typical monthly benefit of $2,200 has a present value well over $500,000. Consider all your Social Security options carefully to avoid making a costly mistake.

A Client Process Everyone Can Understand

If you had the services of a financial advisor working for you, what would you want them to work on?

$ ?s: Don’t Let Your First Paycheck Go to Waste

Q: I recently landed a job that will allow me to begin saving. My company offers a 401(k) and a 3% match, but I also have college debts of $15,000 and a credit card balance of $650. How do you recommend I proceed?

Tax Planning from the 2012 January / February issue of Planning Perspectives

“How can you respond if these new taxes are enacted? One option is to do a Roth conversion so that you can pay taxes now for those retirement funds.”

Roth IRA Recharacterization 2012: Undoing a Roth Conversion

Nearly everyone is an excellent candidate for a Roth conversion this year. You can always undo part or all of a Roth conversion with what’s called a recharacterization, so you can’t convert too much.

Roth IRA Conversion 2012: Roth Calculator for Prof. Low Income

Who would have thought that someone earning $10,700 might want to purposefully push their taxable income up to $217,450 this year in order to pay $47,595 more in taxes at these lower 2012 tax rates?

Roth IRA Conversion 2012: Roth Calculator for Mr. Esq

Who would have thought that someone in the 33% tax bracket now who will be in a lower 28% tax bracket in the future might want to do a Roth conversion at his higher rates now?

Roth IRA Conversion 2012: Roth Calculator for Ms. Small Business Owner

Who would have thought that someone earning $400,000 might want to purposefully push their taxable income up to $1.2M this year in order to pay $280,000 more in taxes at these lower 2012 tax rates?

Roth IRA Conversion 2012: Roth Calculator for Mr. Average

Who would have thought that someone earning $75,000 might want to purposefully push their taxable income up to $275,000 this year in order to pay as much as possible at these lower 2012 tax rates!

Roth IRA Conversion 2012: A Roth Conversion Calculator

Nearly everyone is an excellent candidate for executing a Roth conversion this year. But it is helpful to have a target amount in mind before you begin.

Women Are More Afraid of Becoming “Bag Ladies” Than Men

Women are more afraid of becoming “bag ladies” than men, and it makes them approach investing and saving for retirement differently, assuming they have managed to tackle either of those chores.