We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Roth 401(k) vs. Roth IRA (A Guide for the Perplexed)

A Roth provides more flexibility than its Roth 401(k) counterpart because you can access the principal at any time without penalty.

Stop Saving

It is better that you stop saving and use that money to do some of the things you’ve been longing to do, than it is to quit your job and retire early because you think that is the only way you can achieve your goals.

Roth IRA Conversion 2012: Are You a Good Candidate?

You may be a good candidate for a Roth conversion in 2012 if you can answer “yes” to any of these statements.

Radio: Organizing Your Finances to Best Love Your Spouse

Do you think of being financially organized as a way to love your spouse? David and Krisan Marotta explain why you should.

Countering Resistance

Client resistance is an inevitable part of the financial planning process. It’s a sign the advisor is doing his or her job.

$ ?s: Secondary Annuities Are Second Class

Once you buy this product, you’re stuck. All structured settlement transfers must take place through a court order…

Video: Marotta on Money

Marotta On Money is a weekly financial column and daily financial blog about the comprehensive wealth management small changes that have a large effect over time.

Subscribe to receive more Marotta more often.

The Absolutely Last Chance for a Massive Roth Conversion

A tax tsunami is coming at the end of this year. This will be your last opportunity to safeguard your assets in a lifeboat and avoid getting swamped with taxes.

Ten-Year Freedom Investing Returns

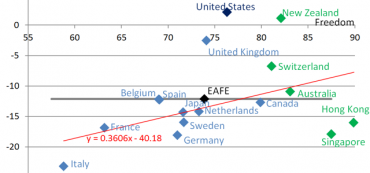

Freedom scores ranged from #1 in freedom Hong Kong at 89.9 to #92 ranked mostly unfree Italy at 58.8.

Five-Year Freedom Investing Returns

Over the past five years, countries with the most economic freedom averaged annual returns just below emerging markets.

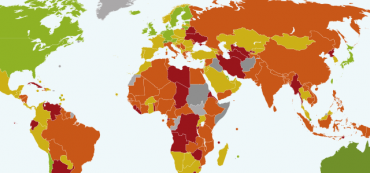

Sovereign Debt and Deficit by Country

Sovereign debt and deficit weigh most heavily on a country’s level of government spending, one of the ten components of freedom in the Heritage Foundation economic freedom study

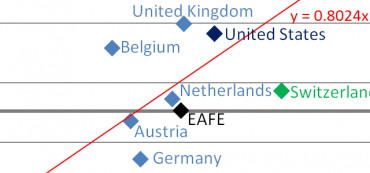

Three-Year Freedom Investing Returns

We believe this is one of the times when your asset allocation should tilt foreign and overweight the handful of countries with high economic freedom.

New Zealand: Economic Paradise

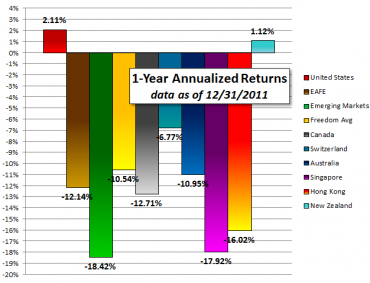

New Zealand, the fourth highest country in economic freedom, joined the United States with positive returns for 2011.

One-Year Freedom Investing Returns

The equation of the trend line shows that every point on the freedom index was worth 0.36% annual return over the past year.

Freedom Investing 2012

Now at year end, I will review how freedom investing fared in 2011 and in the decade since 2002.