We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

In My Dream I Explained Why 2011 Was Not a Financial Mulligan

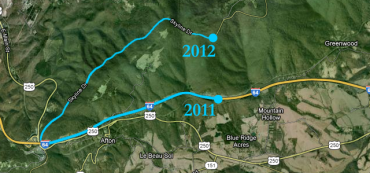

I had a dream in which I saw a map similar to the one above and I heard myself explaining why 2011 was not a financial mulligan

Schwab: Using a Donor Advised Fund for Your Charitable Giving

A Donor Advised Fund is a way to give small amounts to many charities. But take a look at the pros and cons of this strategy before diving in.

Are All ETFs Created Equal?

Much of the recent conversation about ETFs has to do with the hidden risks of “synthetic ETFs,” risks which are not present in their mundane relatives known as “physical ETFs.”

$ ?s: Help Me Conquer the Clutter

Q: My husband hasn’t gotten rid of a single bill or financial statement during our entire 18-year marriage! He received a shredder from Santa this past Christmas, and I am ready to get started, but I want to know what, if any, of this paperwork I should keep.

Monetary Infidelity

If money is among the most common causes of domestic spats, it probably shouldn’t come as a surprise that almost one in four Americans would try to hide money troubles from their spouses.

Mailbag: How Do You Measure How Far Out of Balance a Portfolio Is?

We compute an asset allocation deviation or “out of balance” number for each household’s primary retirement assets and rebalance to lower this number.

How to Select the Best Credit Card

Lots of articles steer you to the best credit card by categories–one if you want airline miles, another if you need to transfer a balance. This is not one of those articles. The millionaire mindset does not want airline miles and doesn’t carry a balance.

Video: Comprehensive Wealth Management

Comprehensive wealth management is based on the idea that small changes in our finances can have large effects over long periods of time. These changes can make the difference in achieving our life goals.

Schwab: What Does Total Capital Gains Mean Under Income Summary

On my Charles Schwab Statement, what does “Total Capital Gains” mean under Income Summary?

Foolish Ideas

“Successful active management is a fantasy stoked by the financial services industry.”

$ ?s: Investment Advice for Those Who Don’t Need the Money

Q: I am a 65-year-old retired widow and I have a large IRA. How should I invest if I don’t need this money?

Indexing Works

“Many investors think active managers can shift out of stocks in time to stem losses in bear markets. Not true.”

Radio: Grow Rich Slowly: The Four Secrets of an Automatic Millionaire

Listen to David John Marotta’s interview on growing rich slowly: the four secrets of an automatic millionaire

Debt, Uncertainty and Volatility in 2011

The world markets groaned as the burden of the rising American debt and the European deficit weighed down more productive countries.

The House That Bogle Built

Learn about the index preferred by the person who invented index funds with the Vanguard S&P 500. And no, it isn’t the S&P 500.