We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

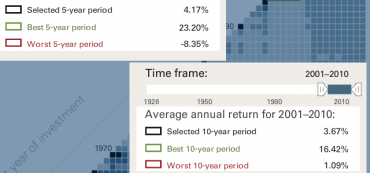

Don’t Panic, the Markets Are Inherently Volatile

On volatile days like yesterday, I always recommend looking at longer term movements.

The Wealth Blueprint for Financial Success

I was asked to speak at the Leadership Development Center at the University of Virginia’s EAN Annual Conference on Thursday, August 4th 2001. I’ve collected links to all the resources I mentioned in that talk here in one place.

To Pay for Investment Advice or to Get It “Free”?

Clark Howard recently advocated using a fee-only advisor generally and the National Association of Personal Financial Advisors (NAPFA) in particular.

Watch Milton Friedman’s “Free To Choose” PBS Series for Free

The legendary PBS TV series “Free to Choose” (1980) by Nobel Prize-winning economist Milton Friedman is now available on Google Video for free (by courtesy of the Palmer R. Chitester Fund).

Personalizing the Debt Shows it is Unsustainable

Our country’s debt and deficit is difficult to understand in the abstract. Translating it to the numbers on each taxpayer’s credit card can help us see how our country’s spendthrift ways have debilitated economic productivity.

Despite Gloomy News, Some Trends Back Economic Improvement

In a recent Vanguard commentary entitled, “Despite gloomy news, some trends back economic improvement”, Mr. Aliaga-Diaz writes that there are many factors pointing to a long term economic recovery.

“Fee-Based” Isn’t the Same as “Fee-Only”

“If you want advice that’s free of such conflicts, you’ll need to look for a true fee-only (not fee-based) financial planner.”

Aunt Bea Knows When She’s Being Taken

A conversation between a wirehouse advisor and a senior citizen who seeks trust

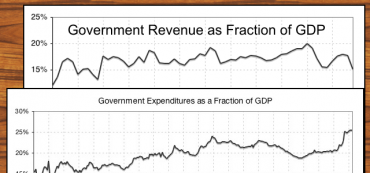

Federal Revenue and Spending as Percentage of GDP

Federal revenue has been relatively constant while federal spending has grown out of control.

Hitting the Debt Ceiling is Not the End of the World

The Obama administration has been claiming that failure to raise the debt ceiling would be the end of the world. We are all tired of failed apocalyptic predictions. Perhaps all that will end is politics as usual.

Financial Troubles Hit Home the Hardest

Money worries are harming marriages and impairing health, according to a quarter of 1,400 married individuals polled online recently by the National Foundation for Credit Counseling.

‘Go Fishing’ in the Calm Sea of Bonds

Adding bonds to an all-stock portfolio can boost returns and lower volatility, especially in choppy markets. Bonds should be a small but important part of your gone-fishing portfolio allocation.

Get More Bang For College Bucks

Before you spot a single Ivy League or big-name private school, public campuses grab 17 of PayScale’s first 18 spots. Leading is Georgia Tech’s 13.9% return on investment. Next is the University of Virginia’s 13.3%.

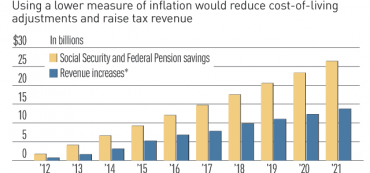

Debt Talks Target Cost Of Living – Social Security Falls Further Behind

To solve the deficit reduction riddle, Obama reportedly is embracing an idea that purports to raise tax revenue without a tax hike and claims to cut Social Security outlays without cutting benefits. Better check your wallet.

Some $100 Billion Locked Up In ‘Sliver’ of Hedge Funds

Despite assurances to the contrary, a segment of hedge funds still has up to $100 billion locked up and won’t allow redemptions.