We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

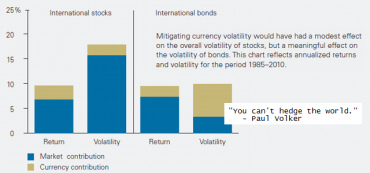

Global Fixed Income (International Bonds): Hedged or Unhedged?

International bonds now make up more than 35% of the world’s investable assets, and yet many domestic investors have little or no exposure to these securities.

Radio: California vs. Amazon Battle

On Tuesday, July 12, 2011 from noon-1pm, David John Marotta was interviewed on radio 1070 WINA’s Rob Schilling Show. The topic was the battle between Amazon.com and the state of California over taxation.

‘Go Fishing’ With Hard Asset Stocks

Hard assets have been one of the most significant asset classes over the last decade. From all indications, it will continue to be a critically important investment category to protect your portfolio from the effects of inflation and the continuing devaluation of the U.S. dollar.

How To Cut Taxes On Your IRA Withdrawals

This article from Donald Jay Korn for Investor’s Business Daily describes the benefits of advance tax planning to reduce the tax bite that is inevitable as you grow older and required minimum distributions (RMDs) become a larger portion of your retirement account.

Obama’s Gasoline Change Doesn’t Change Basic Economics

Last month the Obama administration announced it would release 30 million barrels of oil, the largest ever, from the U.S. Strategic Petroleum Reserve. Only those without an understanding of basic economics would applaud such a move.

Radio: Why Real Estate Should Be In Your Portfolio

David Marotta discusses why real estate should be part of a portfolio asset allocation.

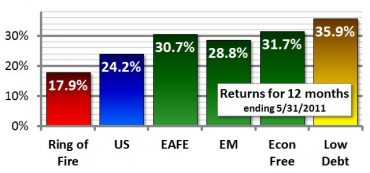

An Overseas Gone-Fishing Portfolio

Even in our gone-fishing portfolios we suggest investing more overseas than in the United States. For most investors, foreign stocks will be their largest and most important allocation. Including the right mix of foreign stocks will help you relax and go fishing no matter which foreign seas are in turmoil.

Radio: Continue to Avoid the Ring-of-Fire Countries

On Jun 21, 2011, David John Marotta appeared on Radio 1070 WINA’s Schilling Show to discuss which countries to avoid investing in, or to underweight, due to high debt and deficit and low economic freedom.

Radio: Continue Avoiding “Ring-of-Fire” Countries

David Marotta discusses avoiding countries with high debt and deficit.

‘Gone Fishing’ American Style

Creating a gone-fishing portfolio begins with a top-level asset allocation. We use six asset categories. The three for stability are short money (maturing in less than two years), U.S. bonds and foreign bonds. The three asset categories we use for appreciation are U.S. stocks, foreign stocks and hard asset stocks.

Continue to Avoid the ‘Ring of Fire’ Countries

Americans seem to be divided on the importance of raising the U.S. debt ceiling. Regardless of your personal politics, avoid investing in countries that cavalierly allow their debt and deficit to balloon.

Relax with a “Gone-Fishing” Portfolio

Summer is almost here. It’s time to go fishing or take a trip or do wherever else you enjoy while on vacation. Unless your interests lie in investment management or you have a trusted fiduciary watching over your investments, consider having a portfolio designed to allow you more time to relax.

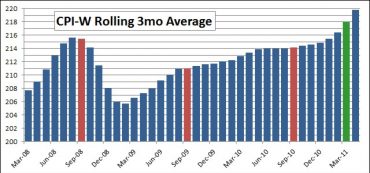

Cost of Living is Beginning to Rise

Understanding how Cost-of-Living Adjustment (COLA) works uncovers some of the complex cause and effect between Social Security adjustments and the real cost of living with higher gasoline prices.

An Obamanomics Lesson For Everyone

If the American family hopes to emerge from this debt crisis, the American people must recover the productive zeal that fueled our country’s growth in the past.

Government Regulations Don’t Make You Safer

The United States has three sectors of the economy suffering under regulatory red tape: financial services, energy and now health care. I’m certain the financial services regulations have caused more harm than good.