We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Assessing Your Finances At Age 50

For many people 50 is a milestone that reminds us to stop and reevaluate. There is still time for a whole new life of significance.

Gold May Drop If Political Winds Change

Perhaps dire predictions are correct and we are headed to Armageddon. If you want liquid assets in such a catastrophic situation, try buying cases of Jack Daniels. It is cheaper, keeps just as well and will fetch more in trading value.

Radio: Now May Be the Right Time to Buy a House

David Marotta discusses interest rates, the housing market, and how these factors work together for the patient buyer.

Dodd-Frank Bill Concentrates Financial Power

Only if you swear by the genius of Caesar, trust in his altruism and believe in his divinity is this bill a cause for celebration.

Saving: the Most Fundamental Element of Wealth

Everything in wealth management begins with savings. All wealth comes from producing more than you consume. Unfortunately, most Americans are better at consuming than producing.

Time To Buy AAPL Stock?

Wall Street loves speculators because they often get out of a stock just as quickly as they got in. And every time a trade is made, a coin in a Wall Street coffer rings.

Radio: Financial Reform & the Dodd-Frank Bill

David Marotta & George Marotta discuss financial reform, specifically the Dodd-Frank bill and its implications on the economy.

Second Quarter of 2010 in Review

For the first time in the Heritage Foundation’s Index of Economic Freedom, the United States was moved from the list of “free” countries to the second tier of “mostly free” countries.

Video: How to Get Out of Debt, Part 2

Everyone knows a family with financial debt. Stop the bleeding.

The Summer Of Our Employment Discontent

Government assistance has taken what might have been a simple recession and turned it into a more lingering malaise.

Invest in All Six Asset Classes

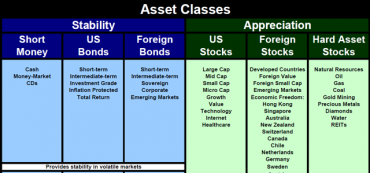

Many U.S. investors crowd their assets into a combination of large-cap U.S. stocks and U.S. bonds. This allocation represents only one and a half of the six asset classes described here.

Life Planning Part 3: Twenty-Four Hours to Go

Imagine that your doctor shocks you with the news that you only have 24 hours to live. Notice what feelings arise as you confront your very real mortality. Ask yourself: What did you miss? Who did you not get to be? What did you not get to do?

Radio: Virginia Land Preservation Tax Credits

David Marotta discusses how to pay your Virginia state tax bills using less expensive Virginia land preservation credits.

Life Planning Part 2: Just a Few Years Left

“Imagine that you visit your doctor, who tells you that you have only 5-10 years to live. You won’t ever feel sick, but you will have no notice of the moment of your death. What will you do in the time you have remaining? Will you change your life and how will you do it?”

Retirement Savings 101: Self-Employment Options

An individual 401(k) (also known as a “solo 401(k)”) offers you the option to defer the first $16,500 of income.