We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Life Planning Part 1: Plenty of Money

Life planning takes a holistic look at what you truly value. And for most people, their life is more important than their money. Only after exploring your life goals can you structure your finances to help you realize your dreams.

Virginia Land Preservation Tax Credits

If the tax code permits a huge deduction for brushing your teeth with your left hand while standing on one foot, it is still worth doing.

Retirement Savings 101: Priorities

With the income tax debate currently controlled by legislators advocating even higher rates, I don’t think you will regret having some tax free money.

Dorothy in Taxland: Tax Credits

Tax credits are much more valuable than tax deductions. Deductions only reduce the amount you are taxed on. One dollar of deduction might only be worth 35 cents. In contrast, tax credits are a dollar-for-dollar reduction in your tax bill. And a refundable tax credit could mean the government will owe you money you never paid in the first place.

Dorothy in Taxland: Overview

A professional tax expert can help you get the correct deductions. But he or she likely won’t motivate you to keep the right records unless you understand the benefits for yourself.

Regular Adjustments Maximize Retirement Success

Retirement planning consists of a wild scatter plot of potential projections. Navigating successfully through possible outcomes requires regular corrections and adjustments.

Spending Retirement Income Can Be Risky

The most common request we get is for a back-of-the-napkin calculation of future yield, interest or income. But rather than being a conservative withdrawal rate, this strategy may actually lead people to spend too much.

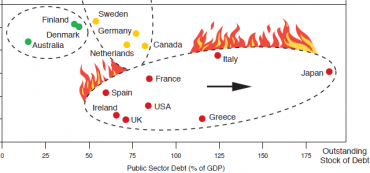

Avoid the “Ring-of-Fire” Countries

A few months ago Bill Gross, co-founder of PIMCO and the country’s most prominent bond expert, singled out those countries heaping significant deficits on their mountain of debt and called them “The Ring of Fire.” We recommend that you reduce your investments in these countries.

Should you invest IRA Funds in Real Estate?

Real estate could be a great investment right now.

Stop-Loss Orders Can Lose Money Quickly

Thousands of investment advisors recommended stop loss orders to their clients. Now it looks like this advice may have been the cause of the May 6, 2010 market plummet.

Now’s Still the Time to Buy a House

Everyone is expecting real estate to underperform the stock market for many years going forward.

Should You “Sell In May And Stay Away”?

When the saying first circulated, May was flat. Since 1987, however, May has done phenomenally well, averaging 2.11%.

Appreciating Assets Part 2: Other Investments

Your investments should be working for you, appreciating more than inflation to become an engine of growth that pays you money and provides some measure of financial freedom.

The Fragility Of Freedom At 60%

In just three short years we’ve added more to the deficit as a percentage of GDP than in the three decades before.

The Fragility of Freedom at 60%

In 1977 economist Milton Friedman wrote an article “The Line We Dare Not Cross: The Fragility of Freedom at ‘60%.'” We are in danger of crossing that line.