We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Mindless Spending 2: You’ll Get By with a Little Help from Your Friends

Both mindless eating and mindless spending rely on our subconscious need to follow scripts to pace our consumption. Community plays a huge role in regulating our financial destiny–either a path of savings that builds real wealth or a path of spending that leads to impoverishment.

Radio: Five Profitable Investment Trends

David Marotta discusses what makes certain investments look attractive.

Mindless Spending 1: Frequency Matters More Than Height

We all think we can’t be fooled by something as obvious as the the difference between height and width. But our brains are wired that way, without exception.

Women Have Unique Financial Needs

Retirement planning is even more crucial for women than for men.

Portfolio Recommendation Beats S&P 500 By 9.4%

Timing the markets this past year was nearly impossible.

Credit Card Karate: The Moves to Block Spending

Just remove the decimal place. The $8.50 lunch you charge will cost you $850 in your retirement.

Using a Credit Card Properly

Your time is worth more than sifting through the ashes of advertising looking for valuables.

Video: Small Business Owners Benefit Most from Tax Planning

Small business owners enjoy more flexibility when it comes to tax maneuvering. That’s why tax planning is especially important for small businesses. Whether your business employs one employee or one hundred employees, last-minute tax moves can save you money, if you act before the end of the year.

Make Sure Your Credit Card Has Smart Features

Themed rewards tend to be toward the low end and cash rewards are apt to be higher. Get the cash.

Video: Year-End Tax Planning Could Significantly Save You Money

Even if you didn’t make a penny more next year, how can you have more dollars for next year’s holiday

season? Reduce your taxes. Between now and the end of the year there are several last-minute tax moves that may save you significant amounts of money. After January 1st, there’s little to do but pay-up.

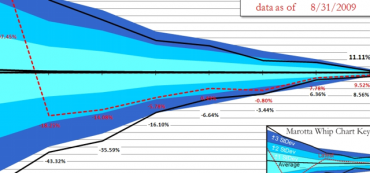

The Whip Cracks Both Ways

Volatility, therefore, is a matter of perspective. Like the crack of a whip.

Time To Rebalance Your Portfolio Again

Because the markets changed course at least once over the past year, rebalancing tended to improve returns.

Video: College Planning is Worth a Million Bucks

Four-years of college currently cost $60,000 at a public university. In eighteen years, it may cost more than $145,000. To stay ahead of rising tuition costs, you should plan ahead and save early. Tax-favored 529 accounts can help you provide an excellent college education for your children and grandchildren.

Radio: A Better Plan For Healthcare

Public policy to increase choices for healthcare coverage.

The Case Against Centralized Health Care

You may have to jail a few rebels for health insurance evasion.