We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Video: Be Smart When You Roll Over Your 401(k)

There are few better investment returns than an employer’s matching contribution made to your 401(k). But after you retire or leave that company’s employment, you should almost always roll your 401(k) into an IRA for better investment choices. Being smart by rolling over your 401(k) can pay dividends for decades.

Video: Be Smart When You Rollover Your 401(k)

After you retire or leave that company’s employment, you should almost always roll your 401(k) into an IRA for better investment choices.

A Compromise to Achieve Universal Coverage

We need a safety net, not a hammock.

More Profitable Health Care Is the Solution

Some doctors start the year $250,000 in debt.

Video: Timing the Market Isn’t All Fun and Games

Market timing is the attempt to switch a significant portion of your assets between different types of investments in an effort to maximize profits. If this is your investment strategy, good luck, because you’ll need it.

Avoiding a Civil War over Health Care

Half of the country are political Vikings who pay their taxes by raiding and pillaging the productive.

Cash For Clunkers: The Economy And The Environment Suffer

A country can’t prosper destroying perfectly good used cars.

Video: The 5 Most Important Documents to Have

Communicating honestly about your finances with your family and putting your estate in order passes on a legacy of foresight and financial wisdom that will help generations to come.

Video: The Five Most Important Documents to Have

Communicating honestly about your finances with your family and putting your estate in order passes on a legacy of foresight and financial wisdom that will help generations to come.

Radio: Cash For Clunkers

David Marotta discusses the politics of “Cash for Clunkers.”

Investment Strategies Part 5: In Defense of Diversification

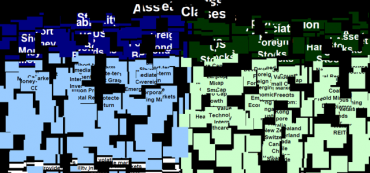

Diversifying your asset allocation among investments with a low correlation can and should reduce your portfolio’s volatility and boost your returns. But critics are claiming this strategy is no longer valid. That’s because they don’t understand the nature of what happened in 2008.

The False Lure of Multi-Level Marketing

Entrepreneurship is for those who feel empowered by hard work, not those trying to escape it.

Seven Termites That Eat Your 401(k)

We call the difference between the market return and typical investor returns the “termite gap.”

Video: Choose the Appropriate Investment Vehicle

There are significant advantages to using different investment vehicles in different types of accounts.

Now’s the Time to Buy a House

Mortgage rates are at historical lows, so the next few years are the time to take advantage of them.