We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Video: The Seven Steps of Financial Preparedness

Here are seven steps you should take to weather any financial storm.

Radio: Tax Management And Planning

David Marotta discusses how to increase your after-tax net worth.

A Full Credit Lockdown

Identity theft is becoming distressingly common as personal information becomes easier to swipe.

Video: How to Avoid Higher Cost Mutual Funds

Investing in some mutual funds is like buying a $3 candy bar and paying $5 shipping and handling. All mutual funds are not created equal, and you can boost your returns by doing a little homework before writing a check.

Last-Minute Tax Savings for College Expenses

Virginia 529 plans allow for an unlimited carry-forward deduction.

Video: Managing Cash is Key to Meeting Goals

Managing your family’s cash is key to meeting your financial goals.

Safeguard #8: Avoid an Advisor with a Lavish Lifestyle

There will always be swindlers masquerading as investment advisors. You can learn to recognize such people by their over-the-top lifestyle.

Video: Foreign Freedom Investing

Countries with the most economic freedom generally do better than the international index.

Safeguard #7: Avoid Investment Advisors Who Sugarcoat Reality

Excellent advisors communicate clearly exactly how bad the markets have been and can be.

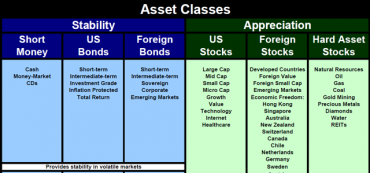

Investment Strategies Part 4: Don’t Rebalance at the Sector Level

Rebalancing between asset classes boosts returns and decreases volatility. But setting your asset classes based on sectors of the economy is not an effective strategy.

Radio: Behavioral Finance

David Marotta discusses behavioral finance.

Investment Strategies Part 3: Rebalance Regularly Between Asset Classes and Subcategories

In this formula is deep wisdom, both for portfolio construction and for determining which categories are worth regular rebalancing.

Video: June: The Month of Wedding Financial Planning

Couples getting married in June usually don’t take the time for pre-marital financial counseling. Yet much of the friction in marriage stems from different financial perspectives, and how money is handled is often a factor in divorce

Investment Strategies Part 2: Use Correlation to Define Asset Classes

Generally, a correlation that can drop below 0.6 with other asset classes is a good candidate to become its own asset class.

Investment Strategies Part 1: Rebalance into Stable Investments in an Appreciating Market

Diversifying your portfolio means finding assets that have value on their own merits but do not move exactly alike. A critical investment metric called “correlation” is used to construct a portfolio most likely to meet your personal financial goals.