We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Achieving Family Harmony in Estate Planning Part 2: Make Sure Your Plan Fits Your Unique Needs

Estate planning must begin with family harmony as the goal. Thus personal dynamics are more important than avoiding probate and estate taxes.

Radio: Learning To Live On Your Own

David Marotta discusses learning to live on your own after college.

American Mercantilism Descends Into Fascism

The government is not intervening out of a sense of altruism.

Achieving Family Harmony in Estate Planning Part 1: Leave Your Estate in the Right Hands

The most important product of estate planning is achieving family harmony. Think carefully when you choose your executor or trustee.

Video: What’s More Important, Saving for College or Retirement?

What’s more important, saving for college or retirement?

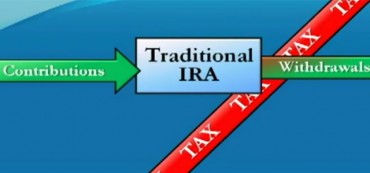

Video: Roth Segregation Part 1: IRA Tax Law

A complex technique called “Roth segregation accounts” could earn your investments an extra 30% over the next two years.

Roth Segregation Accounts

A complex technique called “Roth segregation accounts” could earn your investments an extra 30% over the next two years.

Video: Roth Segregations

A complex technique called “Roth segregation accounts” could earn your investments an extra 30% over the next two years.

Video: Roth Segregation Part 2: Implementation

A complex technique called “Roth segregation accounts” could earn your investments an extra 30% over the next two years.

Getting Started With Investing

There isn’t a better time to invest than today. Getting started can be intimidating, but these simple steps will help you through your first few years of investing.

Video: Getting Started with Investing

There isn’t a better time to invest than today. Getting started can be intimidating, but these simple steps will help you through your first few years of investing.

Radio: Congressional Earmarks

David Marotta discusses the politics of congressional earmarks.

Social Security 6: The 70-66 Strategy

Future earnings and the potential for Roth IRA conversions should be part of your plan.

Social Security 5: File and Suspend for Soon-to-Be Widowed Homemakers

Healthy spouses with little earnings should encourage their partners to delay filing.

Social Security 4: File, Repay and Refile to Get an Interest-Free Loan

Filing early and then repaying is the least dangerous for those who are single or for a husband and wife whose benefits are roughly equal.