We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

How Medicare Works

In some cases you will have to pay the $135 deductible plus 20 percent of the remaining costs.

Fund Your HSA To Cover Retirement Healthcare Costs

Excess contributions to your HSA can be withdrawn after age 65 without penalty just like a traditional IRA.

Kiddie Tax Loophole Soon To Disappear

Use a 529 college savings account to save for college.

IRAs Offer Big Tax Savings for Charitable Gifts

Only contributions made to charity before January 1, 2008 can be characterized as qualified charitable distributions.

Dorothy in Taxland: Below the Line Deductions

Below the line deductions are uncertain. Like many items in the tax code the correct answer to “Will they reduce my taxes?” is: “It depends.”

Dorothy in Taxland: Tax on Marriage

As Glinda advises us, “It’s always best to start at the beginning,” and at the beginning of the tax return is determining your filing status.

Dorothy in Taxland: Above the Line Deductions

Most Americans look backward and only hope that Uncle Sam will return some of what they have already paid, but those with wealth look ahead and adjust their affairs according to the tax code.

University Students: Getting Sucked Dry by Credit Cards

Last week we listed the ways university student are enticed into using credit cards. This week we will examine the economical impact of those initially small and convenient monthly payments.

University Students: Getting Suckered in with Credit Cards

Although 60% of college student’s pay off their balance each month, that leaves 40% who do not.

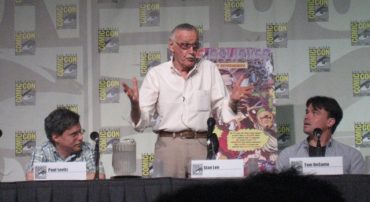

With Great Characters Come Great Stock Returns

Marvel only gets 31% of its revenue from publishing comic books.

Keeping Expenses Low While Building Your Portfolio

Sand can be used to further diversify your portfolio.

Blending Index Funds To Achieve Higher Returns

Even if you only use index funds, you should blend dozens of them in an asset allocation aimed at reducing risk and increasing returns.

Managing Your Biggest Asset: Your Career

A lesser-paying job may be better for your long-term career because of the skills you will gain.

Foreign Freedom Investing 2007

On average, international stocks appreciate more than US stocks. What’s more, companies located in countries with the most economic freedom typically appreciate more than the broader international average.

You Too Can Become a Billionaire

Learning how billionaires amass their wealth may expand your financial horizons and possibly stimulate some ideas that could lead to your name being added in the future.