We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Social Security Is Hopelessly Broken

The wealth gap between blacks and whites widens each generation as a direct result of Social Security.

How to Get Free-Only Financial Advice

NAPFA members give away a great deal of valuable advice.

Exchange Traded Funds

ETFs combine tax efficiency with low expenses.

We Could be in a Real Estate Bubble

The value of any asset category does not go in one direction forever. The housing prices boom shows signs of weakness, and that they may correct or at least under perform for the next few years.

Choose the Appropriate Investment Vehicle – Part 3

There is an art to selecting the right investment vehicles for individual portfolios.

Choose the Appropriate Investment Vehicle – Part 2

Keeping expenses low helps keep your return high.

Why We Need to Fix the Social Security Program Now

We are living too long and we don’t have as many children as we used to.

Choose the Appropriate Investment Vehicle – Part 1

A good investment advisor will tailor the investments to the specific characteristics of the investor’s situation.

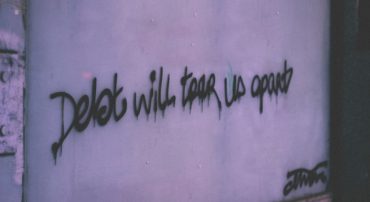

Personal Debt – The Borrower Becomes The Lender’s Slave

The truly rich person is anyone whose income is greater than his or her expenses and whose expenses are sufficient to their desires.

Letter to the Wall Street Journal 12/3/2004

Our children and grandchildren deserve better!

Will Iraq Be Another Vietnam for the US?

The media is making the job more dangerous.

Using S&P 500 Index Funds Contains Hidden Risks

If the S&P were a financial advisor it would say, “Let’s buy mostly large cap growth stocks in the industry that did well last year with a high price per earnings ratio.”

The Benefits Of Canadian Drugs Are A Pack Of Lies

If Canada paid their fair share for pharmaceuticals prices would fall.

Wisdom To Be Learned From The Vice Presidential Nominees

We guarantee you will agree it makes sense to entrust leadership to this last nominee.

Estate Planning For A Family Business Balances Three Roles

Only 34% of family businesses successfully pass to the second generation and only 13% make it to the third generation.