We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Seven Reasons to Avoid Bitcoin

Bitcoin satisfies some of the characteristics of a currency, but there are at least seven areas of concern.

Funding a 5-Year-Old’s Roth IRA

We continued to hire her for several of the same tasks as last year, but also added a few new ones.

#TBT How Long Should I Keep Financial and Tax Records?

Whenever the IRS challenges you, the burden of producing evidence that your claims are true rests entirely with you.

This Month, We Tilted Away from Singapore (April 2022)

Singapore is approximately 37.6% in the Financial sector and has yet to increase its domestic interest rates.

Freedom Investing in Review (March 2022)

This quarter, we saw that in 1-year returns ending March 31, 2022, Developed Freedom Investing had a +1.44% advantage, Emerging Market Freedom Investing had a +2.07% advantage, and Overall Freedom Investing had a +1.28% advantage.

An Overview of Our Allocation Changes (March 2022)

We are constantly reviewing our portfolios’ asset allocations in order to bring them more in line with our Investment Committee’s best practices. Here is a summary of our recent changes.

Best Sub-scores of Economic Freedom for Finding Higher Returns

This year, we decided to analyze the predictive power of these sub-scores on overall future investment returns.

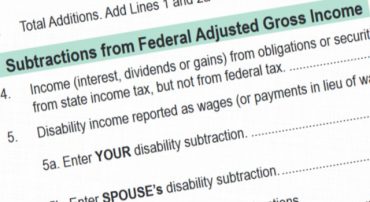

#TBT How to Deduct U.S. Debt Obligations on State Tax Returns

Some states do not tax their residents on income from a mutual fund that was earned on U.S. government obligations.

Marotta Family Saying: Make Half a Mistake

Three generations explain this family saying which teaches one method of mitigating risk.

Radio: How The United States Ruined Its Own Fiscal Health

On Tuesday, March 8, 2022, David John Marotta appeared on Radio 1070 WINA’s Schilling Show with Rob Schilling to talk about “How The United States Ruined Its Own Fiscal Health.”

#TBT Why the Tax on Your Roth Conversion Hurts So Much

Roth conversions pay off. Repeat it to yourself now. Repeat it to yourself at tax time. Roth conversions pay off.

High Inflation, Low Fiscal Health, and What Comes Next for the U.S.

At 4.0% inflation, cash will lose 82.88% of its value over 45 years. Such loss of value can ruin a retirement plan more so than any market returns. Your long term investments need to appreciate well over inflation. The best method to do that is to stay mostly invested in stocks.

Transaction Fees for Foreign Issues Changes Individual Foreign Strategy (January 2022)

At the start of the year, purchases of all of these securities had no transaction fee at Charles Schwab. However in December 2021, Schwab added a transaction fee to some of the holdings.

#TBT How to Report NAP Credits on a Virginia Return

Luckily, reporting and using your tax credits on your state tax return is very straightforward.

An Overview of Marotta’s 2022 Gone-Fishing Portfolios

A gone-fishing portfolio is a portfolio of just a few stocks which should weather the ups and downs of the market fairly well while only rebalancing twice a year.